Let’s go through some of the best methods of accepting payments on WordPress and share some advice on how you can get started accepting payments today.

How to Accept Payments on WordPress

Let’s go through some of the best methods of accepting payments on WordPress and share some advice on how you can get started accepting payments today.

While contactless payments have been around since as early as 2007, their ease of use and tap-feature is more important today than ever before. It first started with credit cards having a chip that works by transferring data to a terminal that has a proper reader, removing the need for a swipe or a pin-input. Nowadays, technology has evolved significantly that even digital wallets and payment systems like Apple Pay and Google Pay require nothing more than your phone for transactions.

Not only is this convenient, but 2020 has found this feature especially useful to avoid unnecessary contact with items that can transmit the COVID-19 virus. Thanks to the radio frequency identification technology, or also known as RFID, these signals can be picked up from a set range for ease of use.

As mentioned above, contactless payments work through chips that have RFID technology to transmit radio waves to a reader. If you are using a credit card, make sure it has the chip for contactless transactions, such as Visa’s payWave and other similar markings on a credit card. When utilizing mobile device-specific payment apps like Apple Pay and Google Pay, your phone must have what is called near-field communication (NFC) to transmit data.

When paying for items, the POS system will usually display an option to tap your card or phone, which should be just as easy as holding it nearby the screen of the terminal. This technology is often not perfect either, meaning it can fail and require you to input your pin instead.

Contactless payments are usable with many devices, as it is slowly becoming a standard for all technologies. While the most common are credit cards and mobile devices; fitness trackers, watches, key fobs, and stickers are also now utilizing RFID technology. These cards are also often used to open doors and gates, as security passes, and other kinds of payment areas.

This technology is great because it is now being recognized by places all around the world. Contactless payment can be used at retail stores, restaurants, bars, cafes, and other automated services for ease of transaction. In some countries, these have even been integrated with public transportation to expedite the riding process.

Using this system saves a significant amount of time and effort you would normally be using to punch in your pin number. Having your phone set up to be your wallet means carrying less cash and cards all the time while also saving you the trouble of fishing around your bag.

Nowadays, COVID-19 is serious, and the fact that you can pay with your credit card or even Apple Pay and avoid touching money makes going out much safer. It is known that the virus can be spread through money due to its fabric material, so going down the route of cashless transactions using contactless payment will expedite everything.

The issue with contactless payments is that if someone else gets a hold of your card, or your wallet or phone is stolen, they can use it to make purchases without any need for a pin input. The fraud activity due to RFID technology is high, so be sure to report any missing cards as soon as possible and check your credit card statements on a regular basis. Report any suspicious and unrecognizable transactions to your bank whenever you see them.

This technology has proven to be extremely effective and efficient not only for payments and transactions, but also for other aspects of business such as security and identification. Thanks to RFID technology, there have been many advancements towards the ease of business, but has also come with risks due to fraud and safety concerns.

Creating an easier way for your business to accept payments has never been easier with Payment Page, wherein our WordPress plugin can create a hosted payment page with ease. Sign up for our services on our website to be at the forefront when we launch our products.

Countries operate in preferences, and the very same applies to payment methods. In the charming country of Austria, customers expect to pay through the EPS, which is a local online transfer payment method. Developed by Austrian banks and the government, EPS is an authenticated bank debit that allows immediate and secure payments. With over 2.5 million Austrian bank account holders, turning EPS down as a payment method can be detrimental to your business venture.

Customers are able to choose EPS as their preferred method of payment during checkout, then selecting their bank. They will then be asked to login their details, promoting them to authorize the payment before crediting to your business account.

If you wish to enter the Austrian business landscape, adopting the EPS payment method is a must. Dominating a market share of a whopping 18%, 80% of online businesses in Austria make sure that they offer the payment method—without it, your customers will be unlikely to trust your brand.

If you wish to learn how to win over Austrian trust and engagement, here’s a quick guide for you:

Step 1: Once your customers are satisfied with the items in their cart, they will checkout on the website. Stripe will then allow them to choose EPS as their preferred method of payment, compelling them to continue the transaction.

Step 2: As they get redirected to the EPS page, they will be asked to choose their bank on a highly secured page. Account credentials will then be inputted into the interface, to be then authorized using a scanner or SMS.

Step 3: Once the account details have been verified, the customer will receive a message informing them that the payment has been completed. Funds will be transferred to your business account, and your move to ship out the item will be the next step.

Given the nature of EPS, the risk of unrecognized payments or fraud is low. Customers are asked to authenticate the payment with their respective brands, meaning that you will not have to deal with disputes turning into chargebacks—your Stripe account will remain untouched. For refunds, on the other hand, EPS allows customers up to 180 days after the payment date.

The advantages of the EPS payment method for the customers are undeniable, but what kind of privileges will you enjoy as a business?

For one, you’ll be able to enjoy a real-time online payment method. This means that you’re offering unparalleled convenience to customers, all without the risk of returns and disputes. You’ll also be able to enjoy the advantages of offering a trust local payment solution, which is exactly the prompt you need to increase sales.

Payments initiated cannot be reversed by the bank, and your Stripe business account will remain intact. Customers are also automatically enrolled, saving you the trouble of conducting registrations.

The modern marketplace is highly competitive. With so many merchants and entrepreneurs in the space, it can be difficult to win over new customers, especially in a new target audience. It’s therefore vitally important that you know exactly what compels prospective customers to trust your brand. In more ways than one, simply offering their most preferred payment method can do wonders for your business venture.

To discover payment methods to try, Payment Page is ready to help! Offering a payment page builder integrated with Stripe, we’ll help your business soar into new heights. Dedicated to helping entrepreneurs diversify their business operations, we’re exactly what you need for continuous growth, security, and reliability. To learn more, reach out to us today!

One inevitable challenge that business owners face is when their eCommerce sales or subscriptions start to plateau—or even decline.

If you are going through this phase at the moment, don’t get discouraged! These things naturally happen at one point (sometimes even more) throughout your operations. On top of that, there’s usually a way for you to pick yourself up and get back on track.

When it comes to boosting your sales online, however, it’s helpful to remember that there’s no one-size-fits-all solution. Every business is unique, so the strategies they need to drive their eCommerce sales will naturally differ as well.

On that note, you will learn of smart and practical ways to improve your revenue in the sections below. Feel free to experiment with these and mix and match items until you find the strategy that works for you.

A common mistake business owners make is focusing all their efforts on acquiring new customers. While customer acquisition is essential to keep your business afloat, you must also pay equal attention to retaining your existing customers.

Compared to new customers, loyal customers are more likely to add more items to their shopping carts. On top of that, they also tend to have a higher conversion rate and generate more revenue for you for each of their visits.

Keeping your existing customer base engaged is a cost-effective strategy to drive your sales.

There’s no denying the fact that consumers love videos. In fact, a study shows that the average user spends 88% more time on web pages that have videos in them.

Considering this insight, incorporating videos in your promotional strategy may be worthwhile. Videos can easily draw the attention of prospects because of their audio-visual content. On top of this, they help create brand recall in your audience.

If you have a product offering that must be operated in some way, producing video demonstrations is worth giving a shot. This not only draws the attention of prospects but also educates them about the uses and benefits of your product.

Today, more people are accessing the Internet through their phones. Furthermore, 40% of mobile users have bought something online using their devices.

This is something you can’t ignore as an online business owner. You must make sure that your website is optimized for mobile devices; otherwise, you may be driving potential sales away. This may even be the reason why you’re seeing a decline in sales or subscriptions.

A mobile-friendly online eCommerce website delivers the convenience and speed that customers want in their online shopping experience.

One of the most important things you have to remember if you want to drive more sales is that you must prioritize your customers’ convenience.

Payment options are a crucial aspect when it comes to providing your customers with a pleasant online shopping experience. No matter how good your product offering is, if you only accept Visa and MasterCard, you may be alienating lots of potential customers.

Ensuring that you can accept debit cards in addition to credit cards may be the missing piece you need to unlock your eCommerce website’s full potential.

Stagnating or declining sales does not necessarily mean that your product offering is not attractive anymore. Most of the time, it indicates that you must devise new and creative ways to market and sell it on your eCommerce site. If you aren’t sure where or how to start, begin with the tips mentioned above. Experiment on various executions, refine your strategy, and you’ll be well on your way to devising the best way to boost your sales.

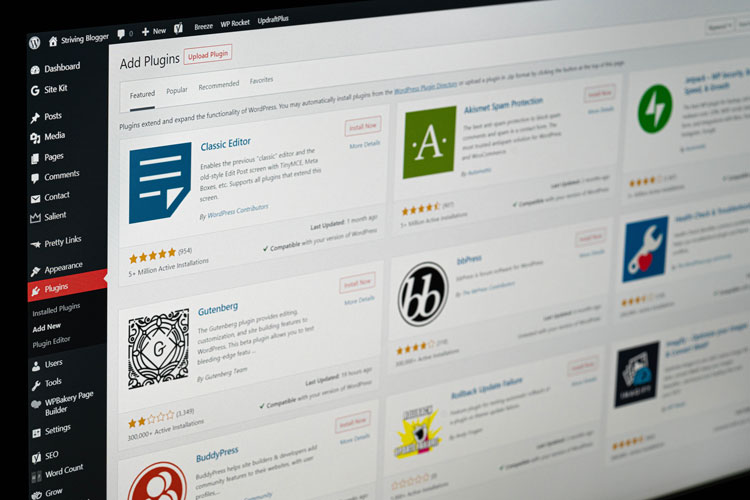

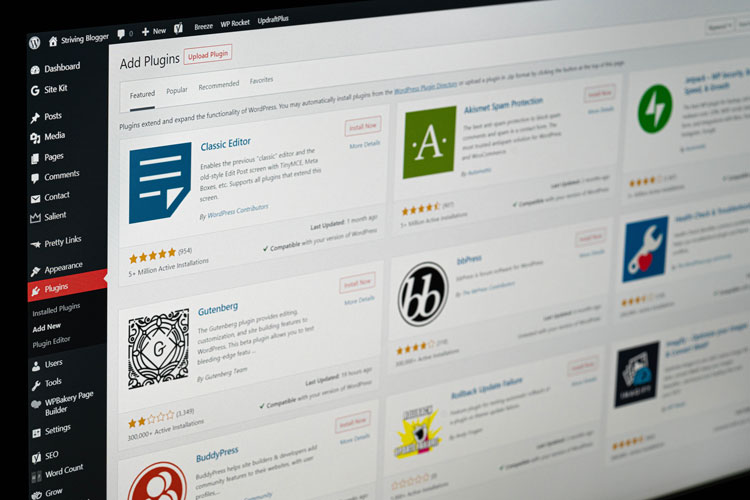

If you’re looking to reinvent your payment form to boost your sales, why not consider Payment Page? This WordPress plugin integrated with Stripe can make it easier for you to accept recurring payments for your eCommerce store. Head to our website today to get Payment Page as soon as we launch and save up to 30%!

Being an online teacher nowadays is an exciting venture now that more homebound students are looking for virtual classes this 2020. According to Freelancers Union, the boom in online work only proves this, with almost 57 million Americans doing freelance work in 2019 alone.

So if you want to jumpstart your freelance teaching career, there are several things you have to consider, and perhaps one of the most important ones is how you get paid. If you’re confused about the new ways of transaction nowadays, don’t worry because receiving payments is now made easy and efficient with technology.

Here are some modes of payment you can choose from to help you find the most accommodating transfer for you.

The classic bank check deposit has always been the norm for many. With no additional fees, you are assured that you get the full payment you deserve. The downside, though, is that there are possible delays in its mail transfer as it arrives and clears into your bank account.

If you’re in for innovative modes, you can choose to get paid via Electronic Funds Transfer or EFT. It works by directly moving your funds from bank to bank without involving apps or credit card processors. However, funds can take around two to four business days, but at least you don’t have to transfer it again to yours, just like how PayPal works.

Most commonly used by freelancers because it’s easy. Clients transfer funds to your account electronically, and once you receive them in your PayPal account, the amount instantly appears. But, transfers to your bank account may take more time, so if you’re in immediate need, you may pay additional fees. There’s also an option for a PayPal debit card if you want to spend using your PayPal balance instantly.

Sign-up is free, but you lose 2.9% of it to transaction fees based on the amount you expect to receive for PayPal payments you receive. While it seems only a fraction, if you consider PayPal for a long time with multiple transactions, the sum amount can pile up, therefore, losing significant money on fees instead of it all ending up yours in full.

Payments via credit cards are processed through PayPal as well or any other online payment system.

Some freelancers take the extra step by getting their credit card processing equipment to receive payments. It requires wireless credit card terminals, processing software, or a merchant account. Others even get hardware that works with mobile devices to cut the need for bulky terminals at checkout counters.

It’s important to consider that most freelance teachers who use this mode of payment use apps or other service providers to get paid. Some of these options include Google Wallet, Square, or Quickbooks. Nonetheless, the list above explores some of the most reliable gateway options that offer both credibility and convenience for freelancers across the world.

If you’re looking for more different online payment methods that you can integrate into your business, Payment Page is your best option! We aim to make it easier for you to implement, making it possible to receive global payment support in just a few clicks with our WordPress plugin that helps create a hosted payment page seamlessly.