Creating an elegant, versatile payment page is now super simple

Payment Page, an innovative WordPress payment plugin, helps you create a customizable payment form in less than 60 seconds.

Do you want to set up a beautiful and

customizable payment form on your WordPress website?

Payment Page has you covered.

Easy Installation

Drag-and-drop form builder for easy customizations

Supports multiple payment gateways and methods

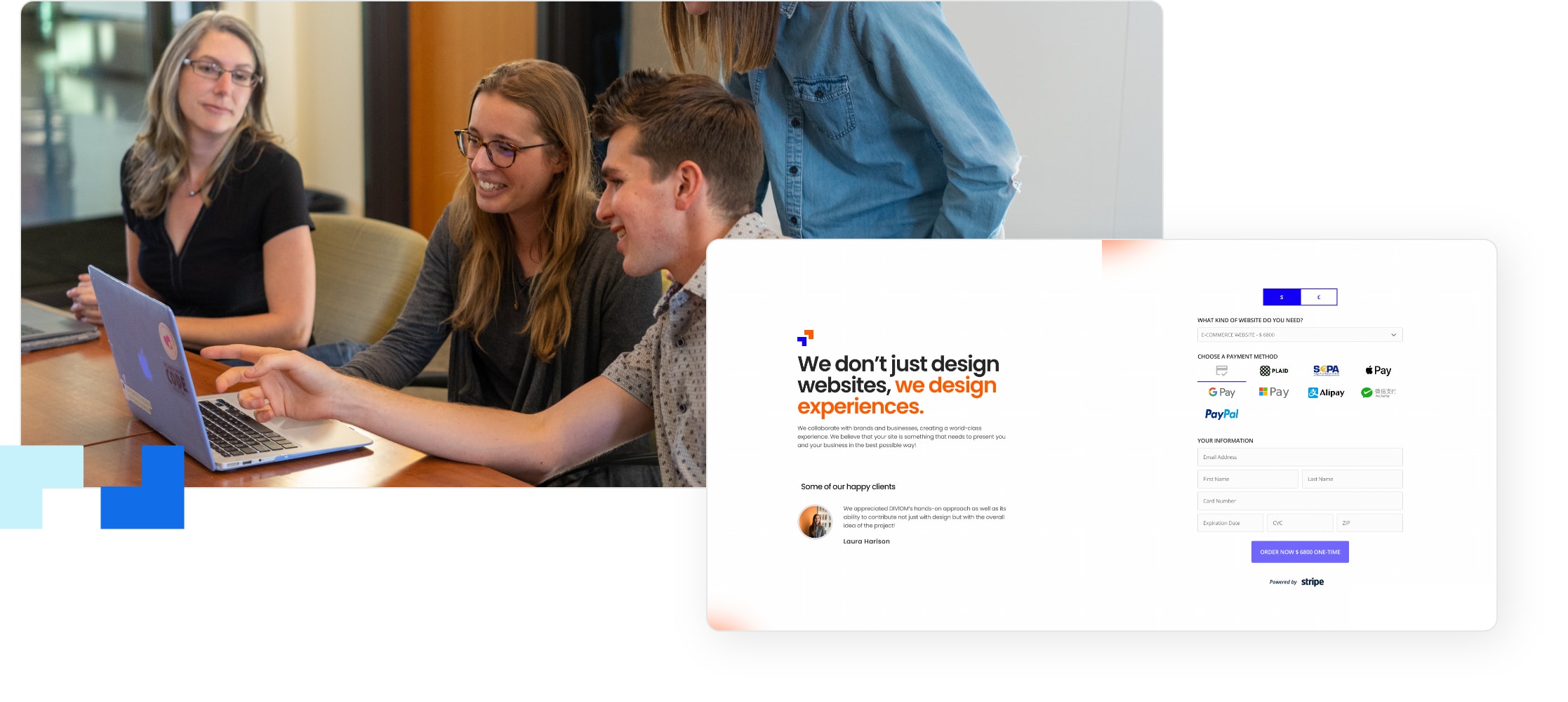

Complement your brand with a beautifully responsive payment form

Create a mobile-ready payment page without any coding

Fully customizable pricing plans

to suit your business model

Affordable for any sized business to get started

Detailed documentation and easy to follow video tutorials

“One of the best plugins to receive payments online.

They offer a lot of custom futures, different types of payment gateway integrations and it’s so easy to install it and set it up in less than 10 minutes.”

Peter Bartesch

Yoga Instructor

Setting up a payment page on your WordPress website has never been easier

Setting up a payment page on

your WordPress website has never been easier

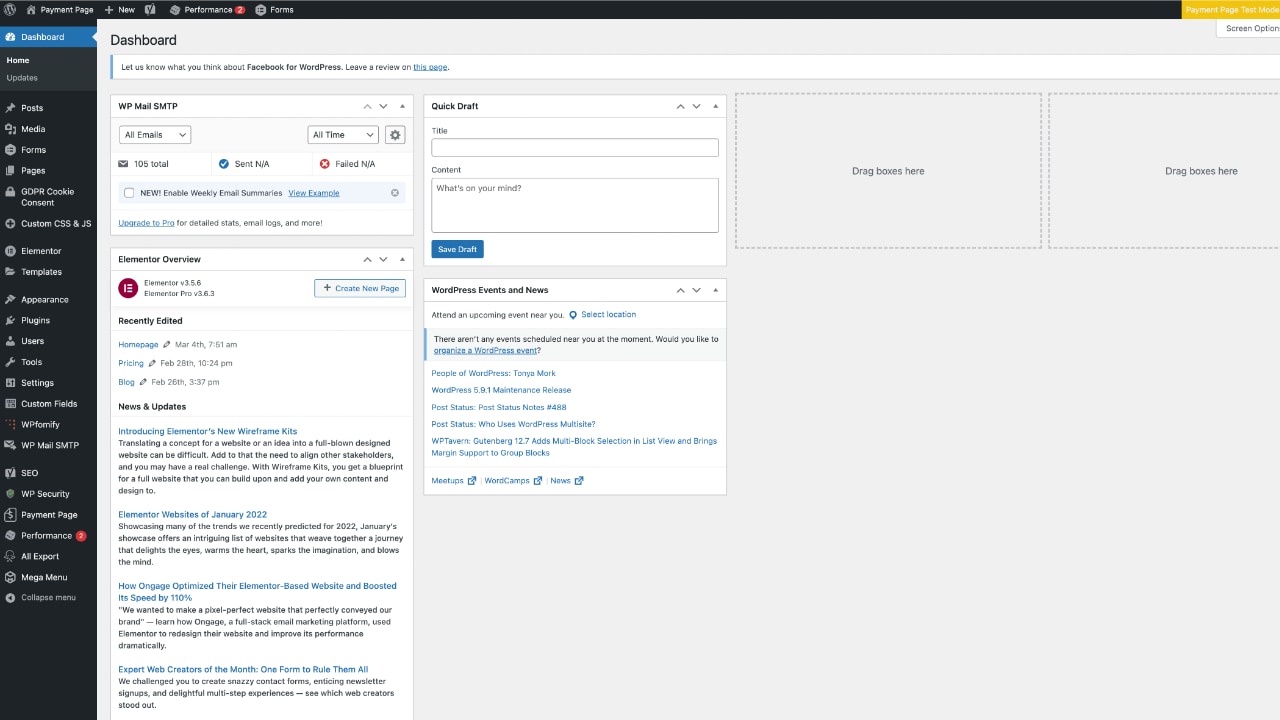

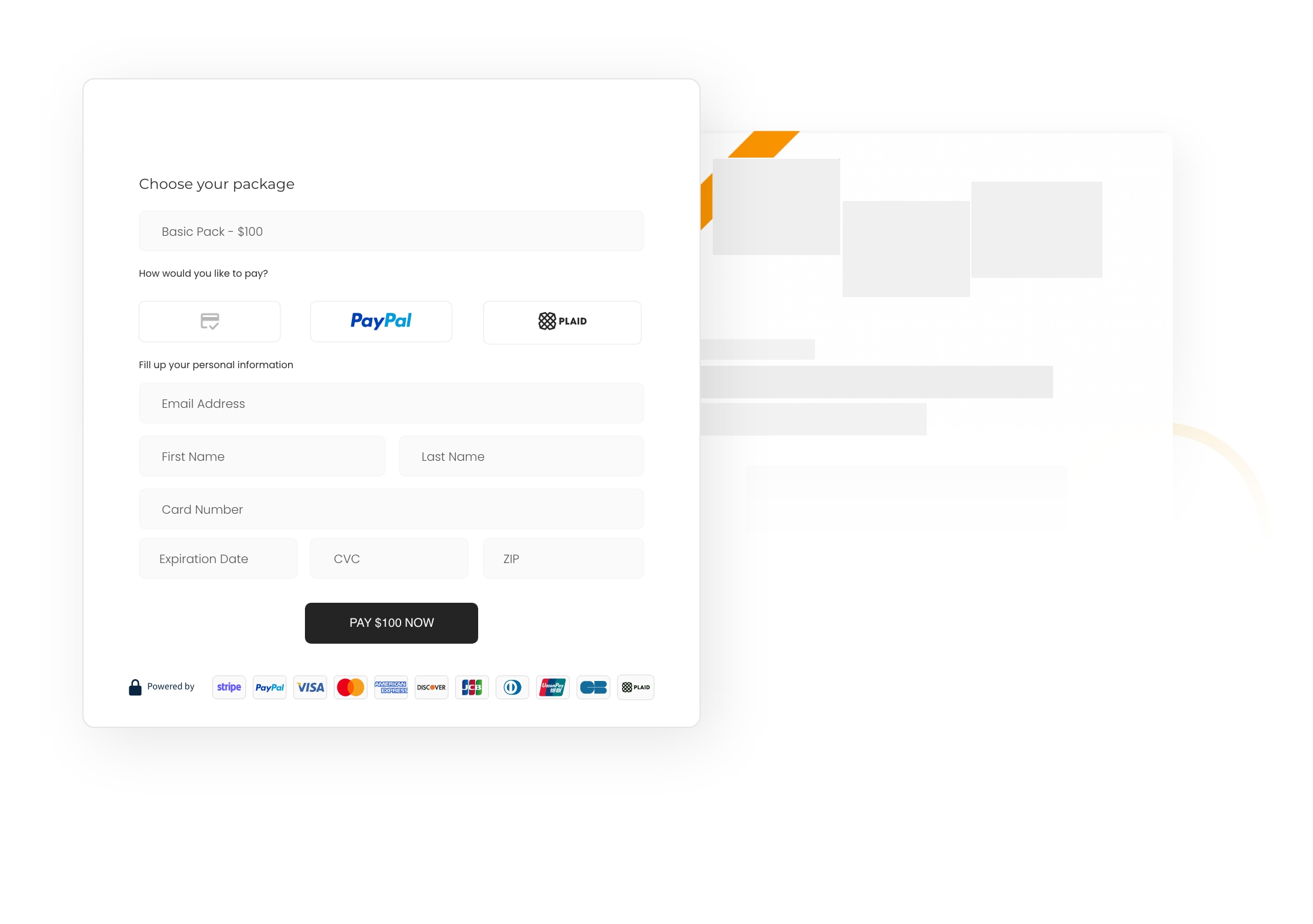

01. Install

Install Payment Page from the WordPress admin dashboard.

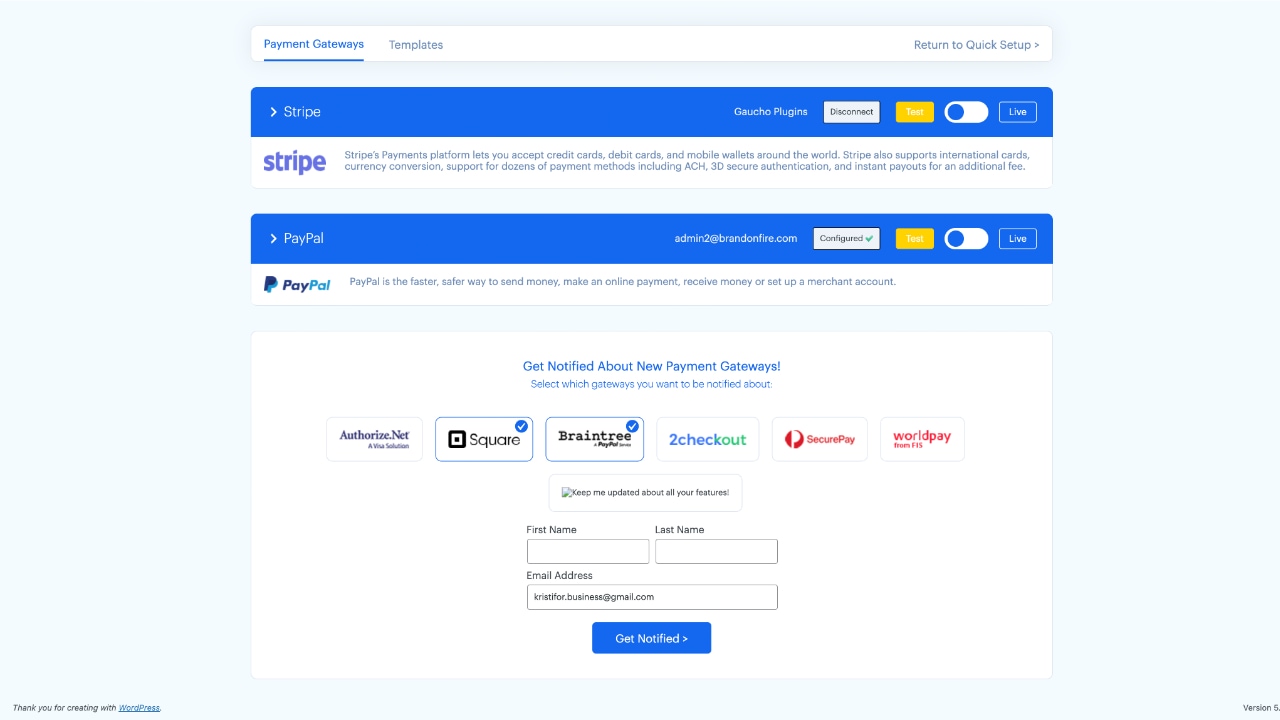

02. Set up

Connect your preferred payment gateway.

We currently support Stripe and PayPal. More payment gateways are coming soon.

Import a Payment Page template or customize your own page.

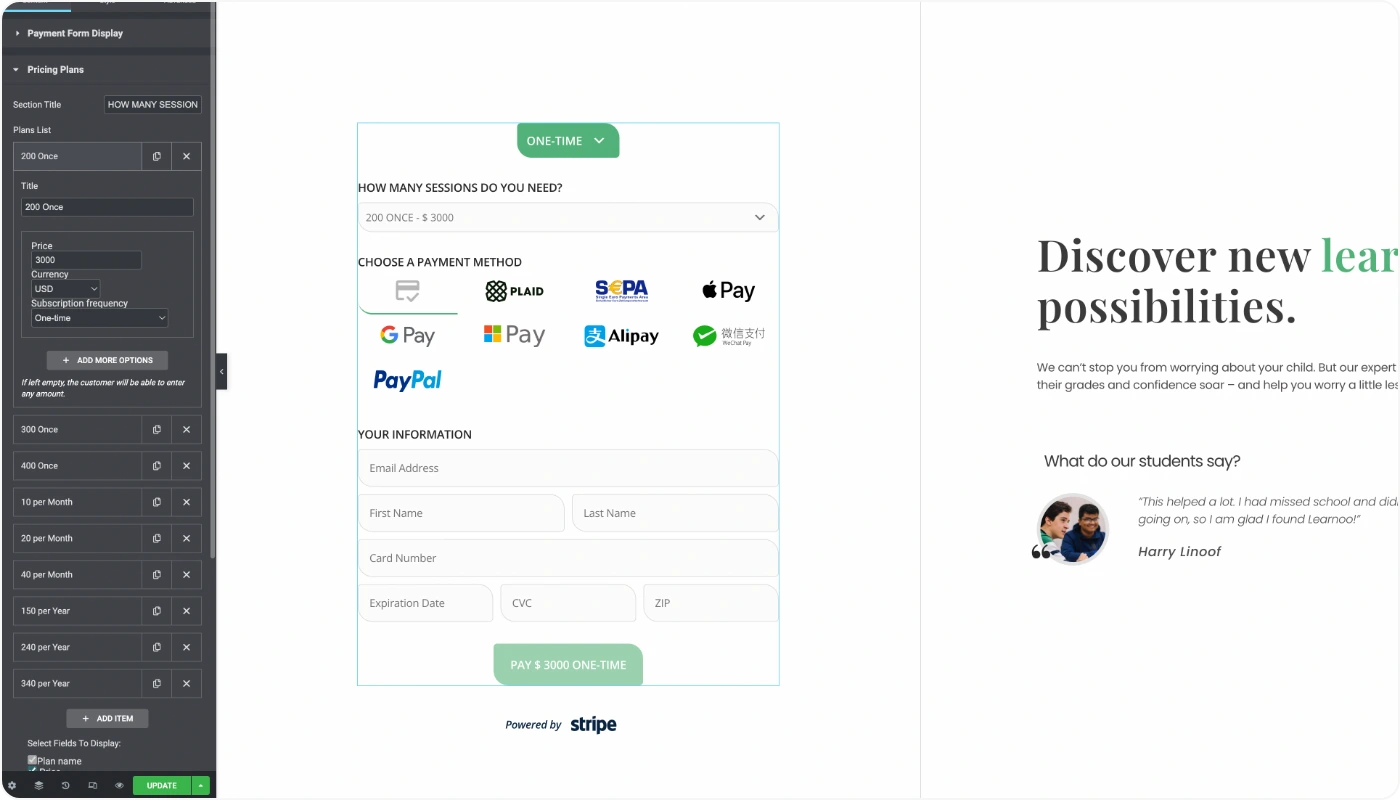

03. Customize

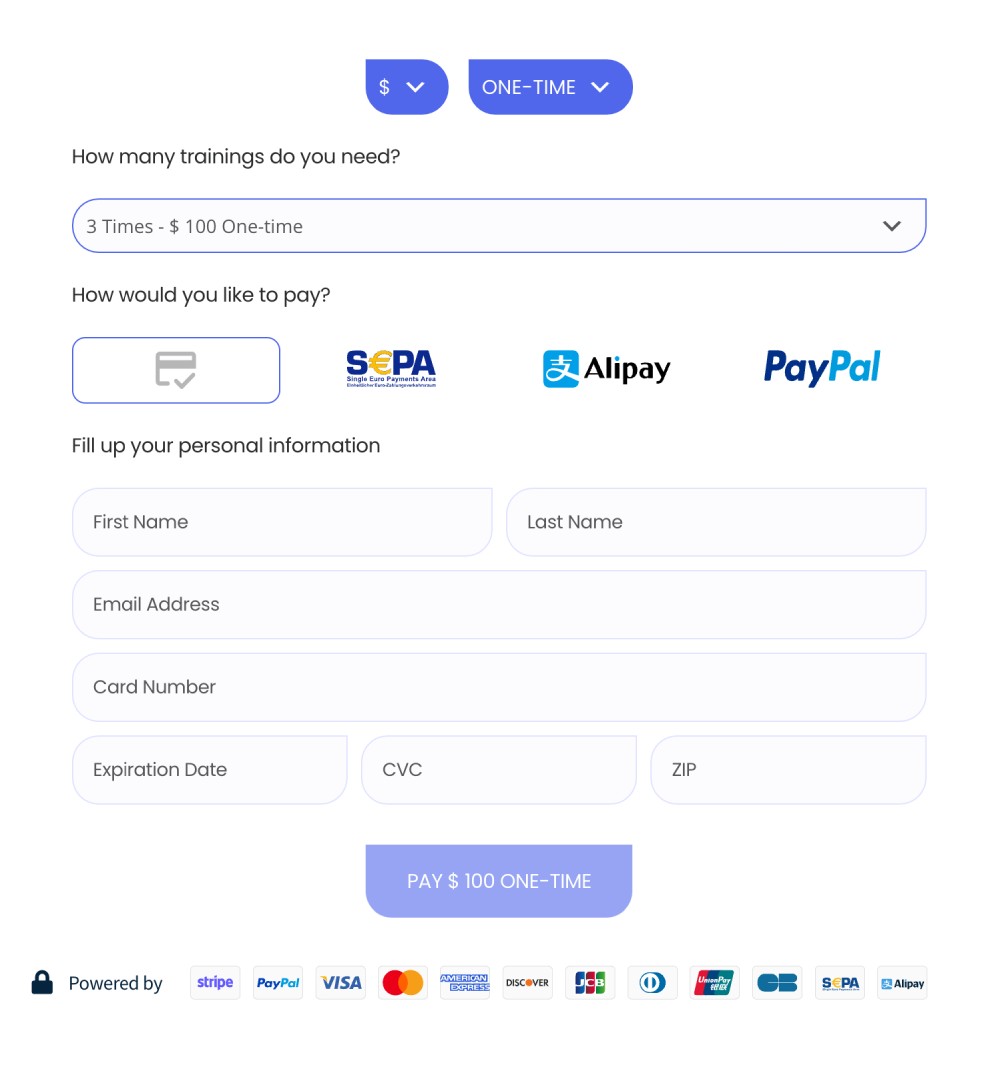

Customize your pricing plans to enable one-time, recurring payments, or custom amounts.

Enable international transactions with multi-currency support.

Add unlimited pricing plans and filters to help your customers choose the right option.

Customize the look and feel of your payment form.

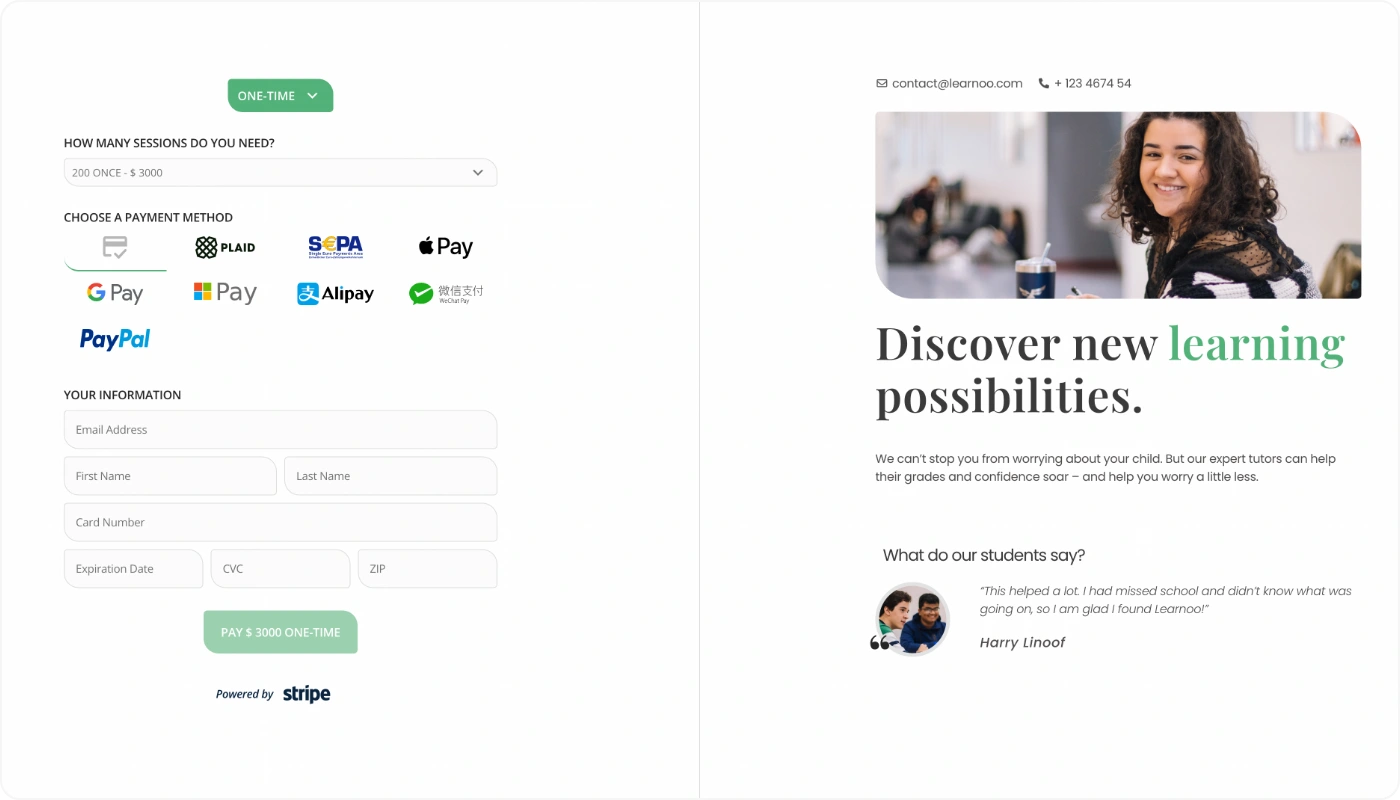

04. Publish

Publish your payment page, and you’re ready to accept payments.

Try our live demo for free!

- Kristifor Pirkovikj

- Website Designer

“They offer a lot of useful features like custom payment amounts, different types of payment gateway integrations, and it’s so easy to install and set it up in less than 10 minutes.”

- Yoshua Reece

- My Teacher Shop

“Simple and attractive – it’s the perfect solution for accepting payments from my students. 5 stars for the plugin, and 5 stars for the excellent support team!”

Payment Page has a wide array of powerful

features to boost your brand

Payment Page has a wide array of powerful features to boost your brand

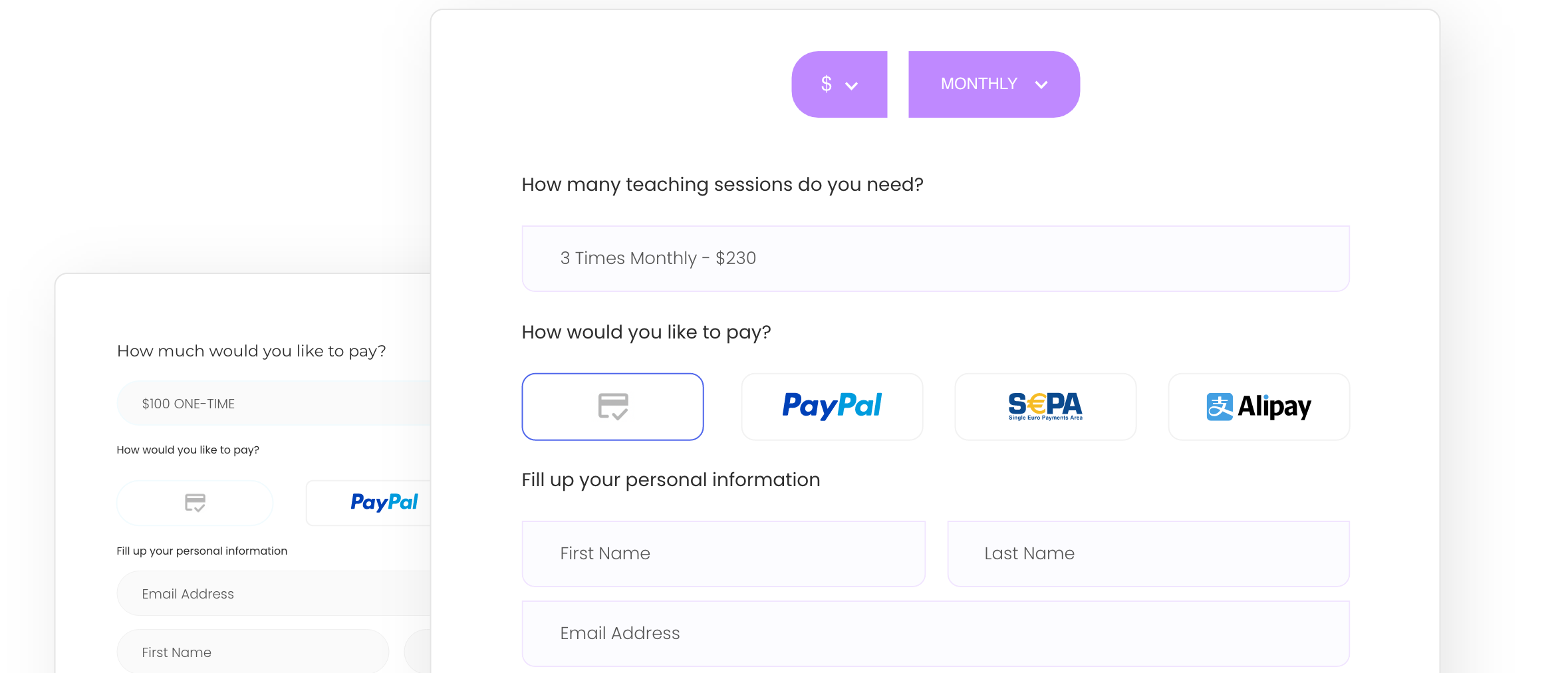

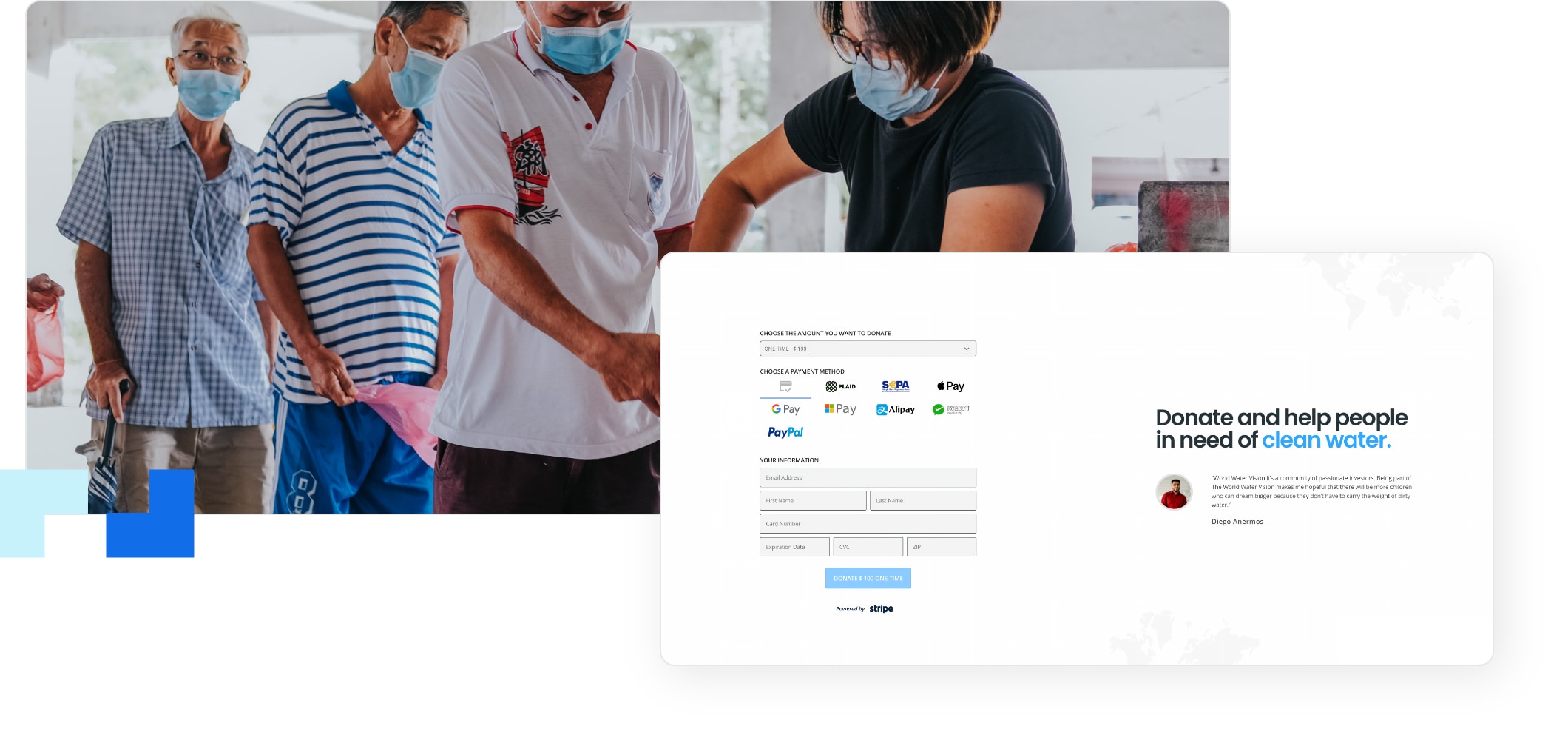

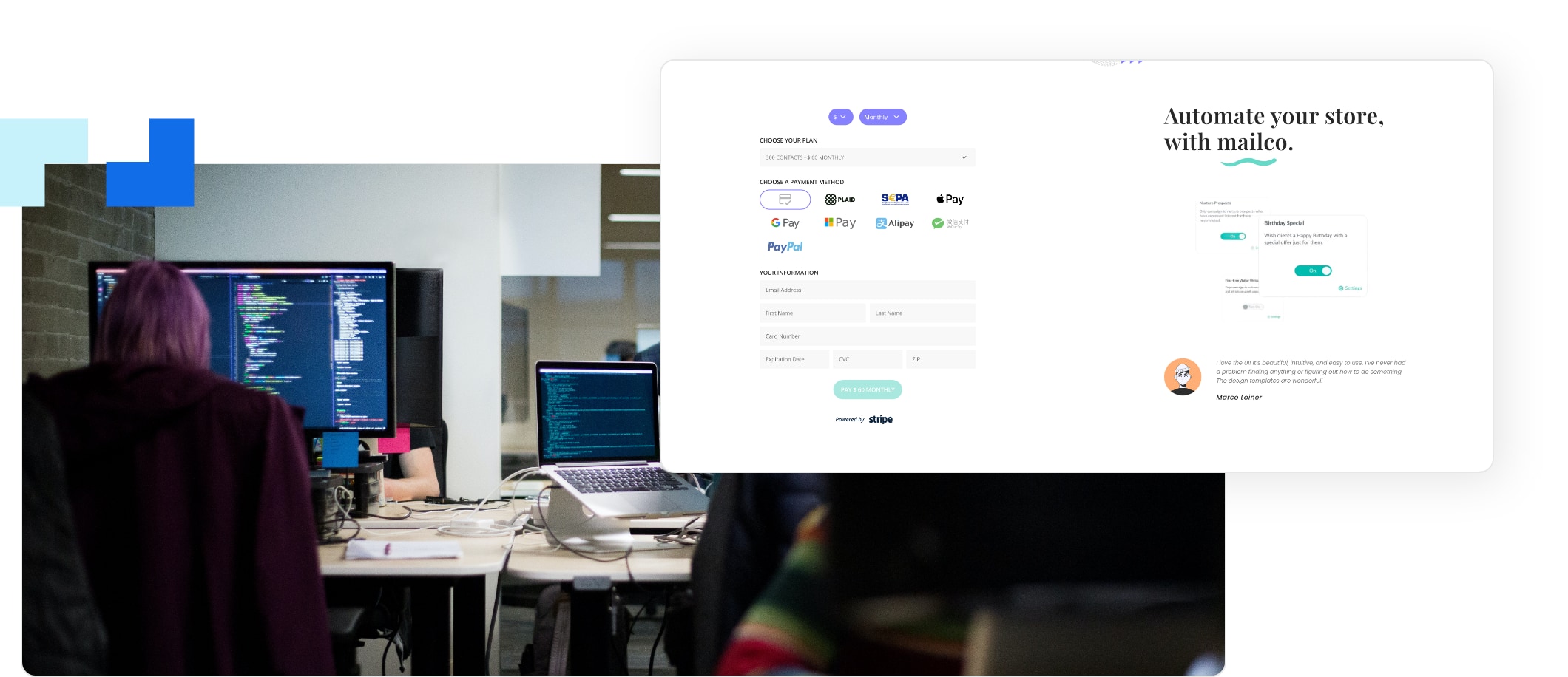

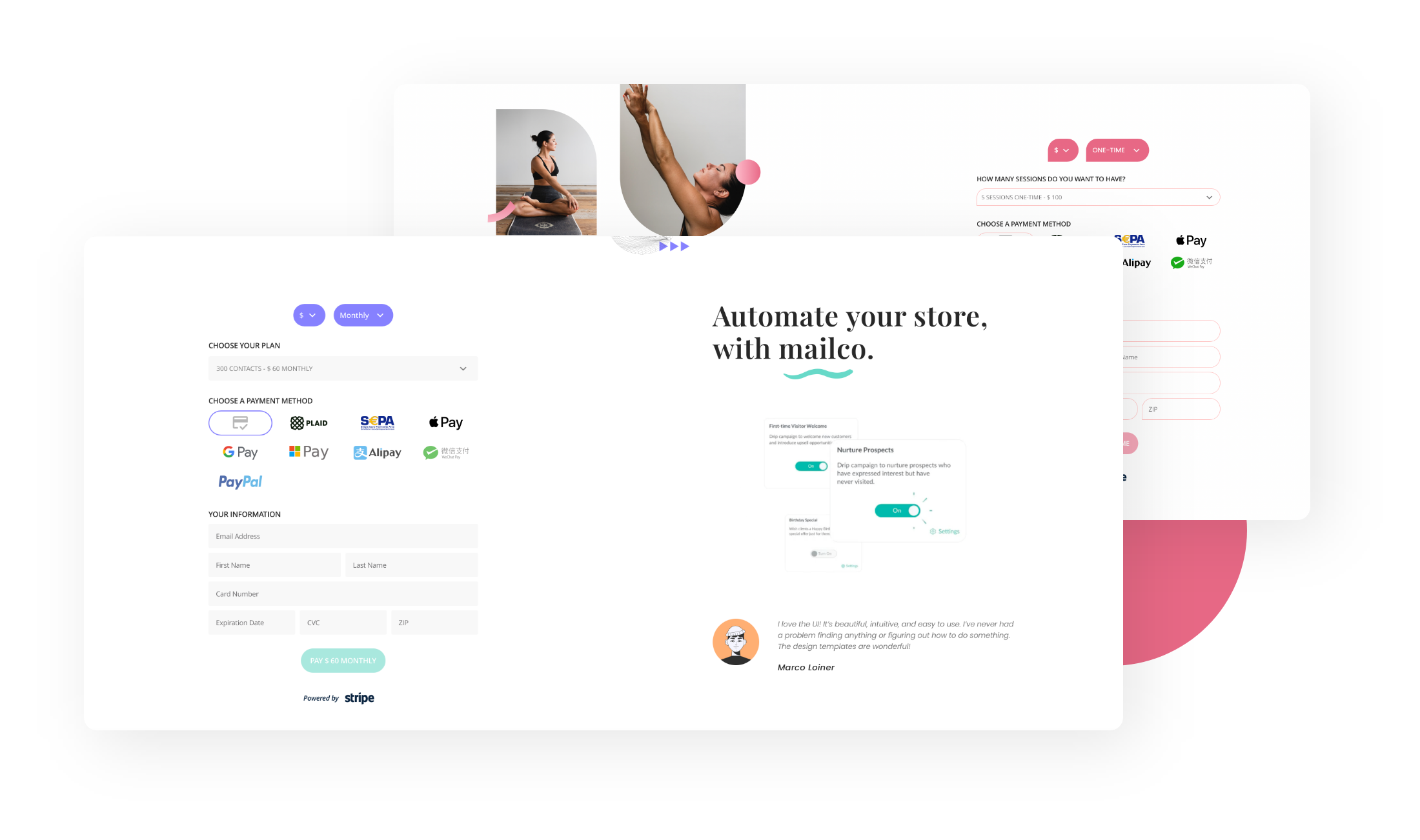

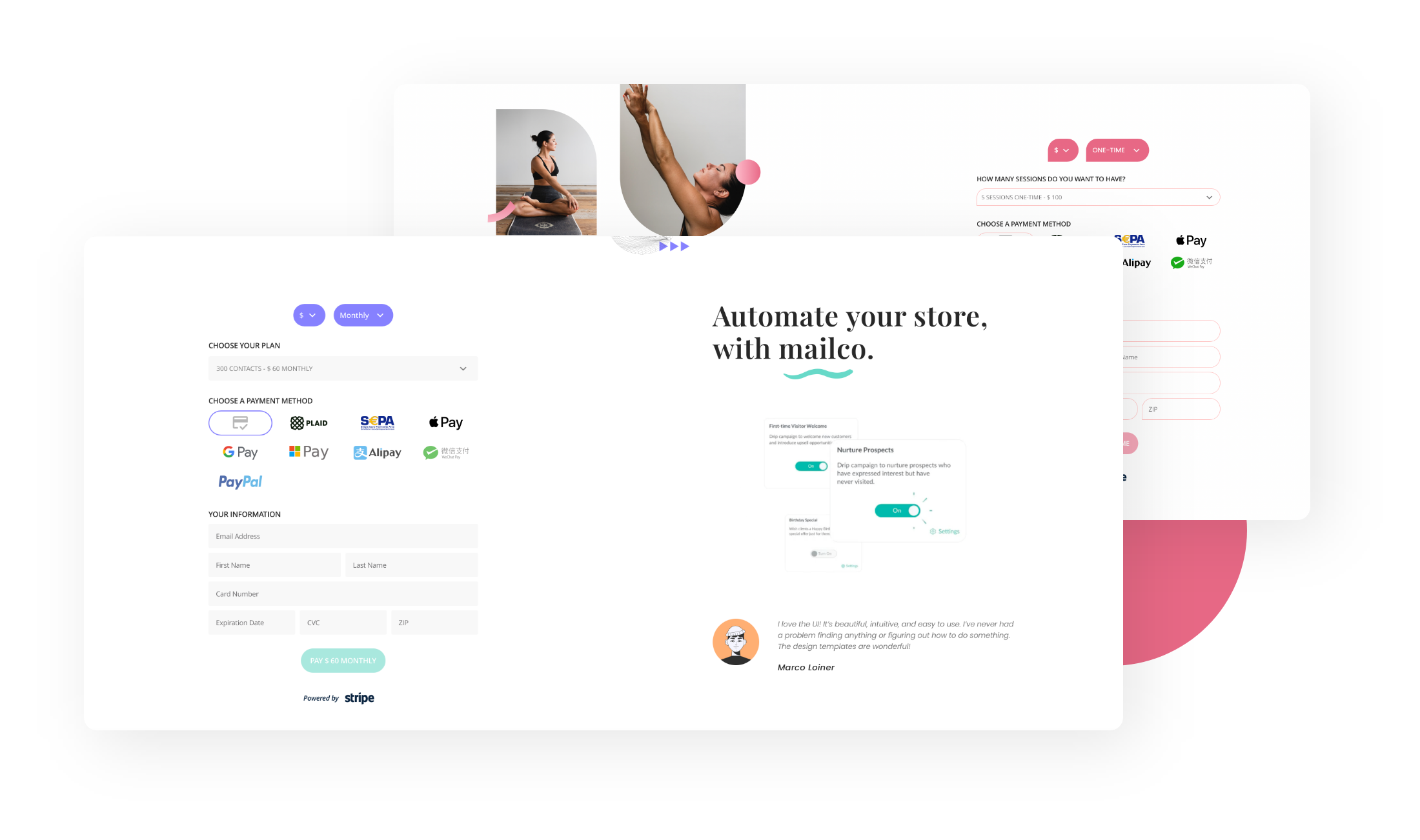

Beautiful, customizable payment page templates

- Set up single page checkout on your WordPress website with our conversion-focused payment templates.

- Customize the look and feel of your payment page to suit your business.

- Payment Page offers use-case specific templates for online coaches, membership sites, freelancers, non-profits, SaaS, and many more.

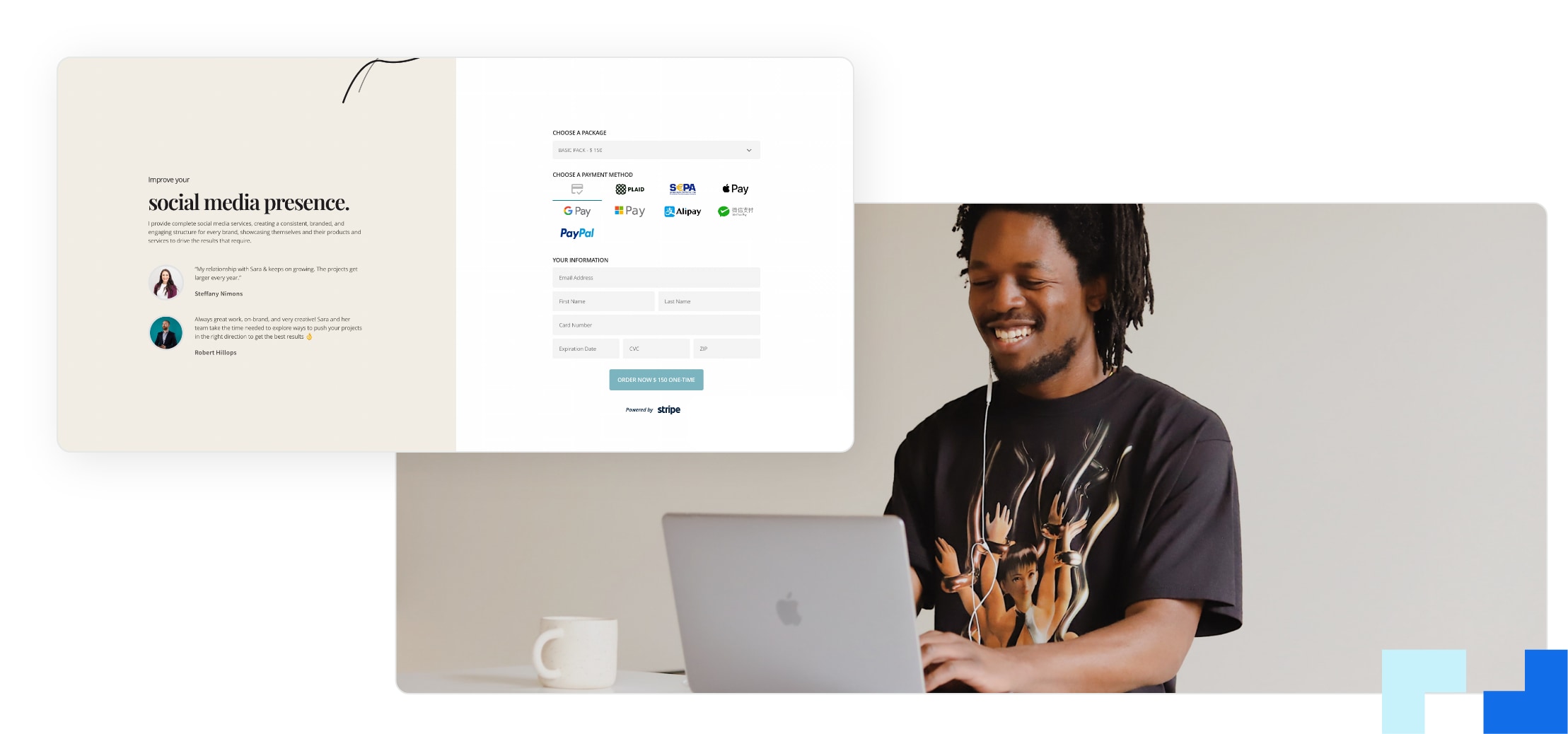

Multiple payment gateway support

- Payment Page currently supports Stripe and PayPal payments on WordPress.

- Diverse payment methods like credit/debit cards, Google Pay, Apple Pay, Microsoft Wallet, Alipay, WeChat Pay, and SEPA Direct Debit.

- Stripe + Plaid Integration for ACH Debit.

- Payment integrations for 2Checkout, Square, and more coming soon

Feature-rich payments forms to support your business niche

Feature-rich payments forms to support

your business niche

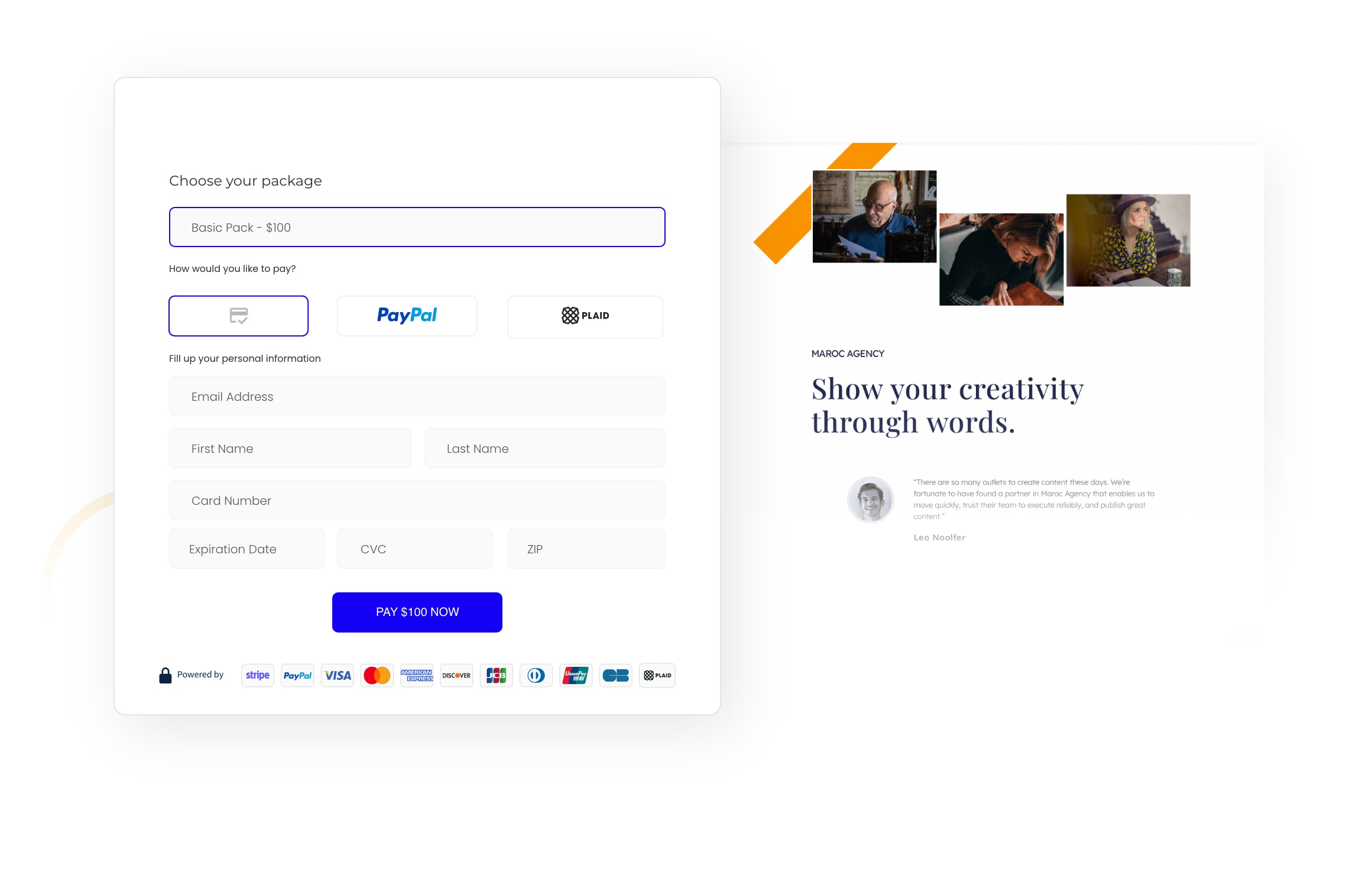

- Set up one-time or recurring payments with Payment Page.

- Payment Page’s versatile payment form supports unlimited pricing plans.

- Define your pricing plans or allow custom payments.

- Add currency filters and subscription filters to let customers choose between any of your plans.

- Supports custom payment form fields and payment gateway dependent fields.

- Accept one-time or recurring donations with the custom payment amount feature.

- Support for one-click upsell and order bumps (coming soon!).

Pays for Itself

Stop wasting time and energy chasing payments. You’ll gain significant savings that’ll cover the cost of Payment Page in no time.

that’ll cover the cost of Payment Page in no time.

- With the recurring payments feature, you’ll never miss a payment.

- Simple and versatile payment forms help your clients pay without hassle.

Want to try it out? We have a freemium model to get you started.

Looking for advanced features to optimize your checkout experience? Paid plans start at just $99/year.

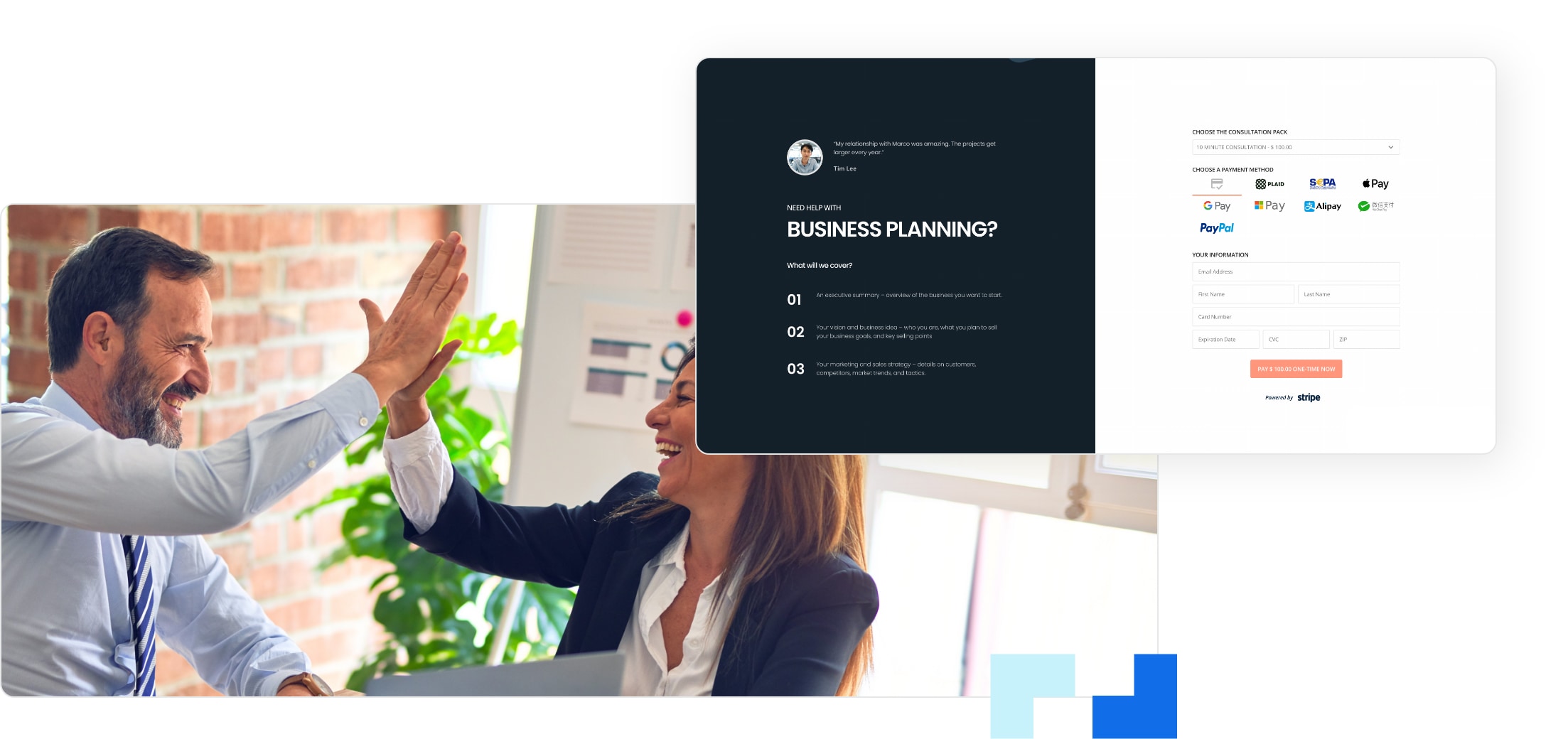

No matter your niche, Payment Page

caters to all your online payment needs

No matter your niche, Payment Page caters to all your online payment needs

Do you need a simple payment form

plugin for WordPress?

Do you need a simple payment form plugin for WordPress?

Are you looking for a branded payment flow that

can be seamlessly integrated?

Are you looking for a branded payment flow that can be seamlessly integrated?

Payment Page offers advanced payment forms with exceptional customization options. You can change the look and feel of your payment page to suit your brand’s personality.

“I needed a great little plugin to help me accept payments from customers when I was in China.

The support team did a fantastic job of helping me get through a few technical issues at the beginning and now we’re all up and running!”

A great plugin from a great company.

Richard Ellis

From Gracy and Doty

Are you looking for a new WordPress payment plugin?

Are you looking for a new WordPress payment plugin?