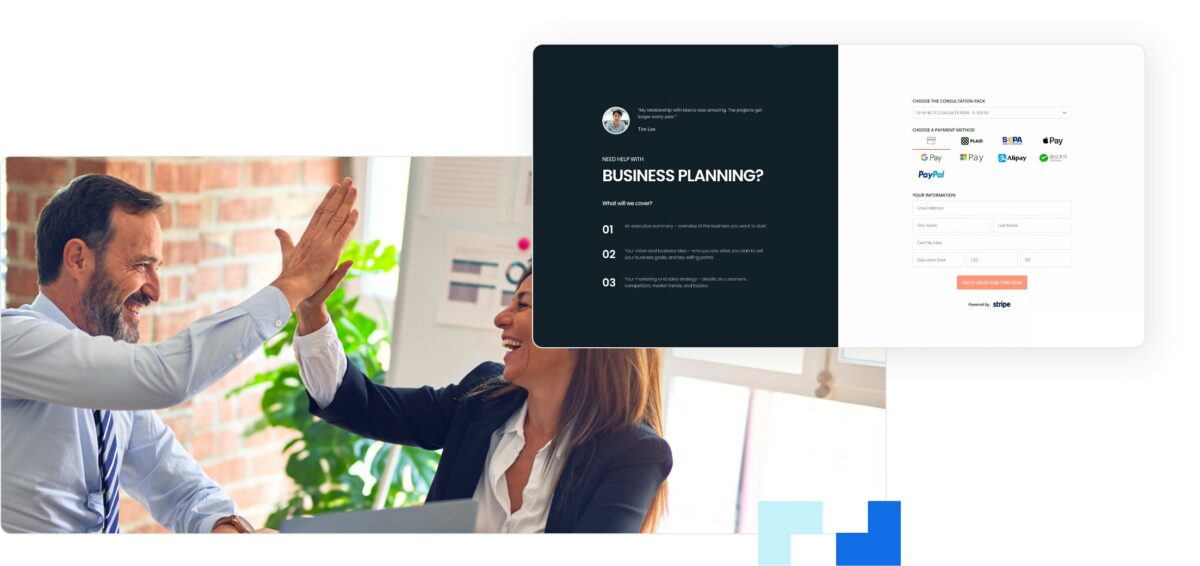

What Is A Hosted Payment Page

A hosted payment page is a webpage that allows clients to enter their credit card information and use their cards to make payments for the goods or services they purchase. A third party hosts WordPress that accepts credit card payments for the company selling the goods or services. The company receives an email notification when the price is full and a third party has received the funds. The third party asks for a transaction fee to cover their processing costs and make a profit.

4 Reasons Why your Business Needs a Hosted Payment Page

2. You Have The Option to Void a Payment

A customer may not be fully satisfied with the product they bought. They may contact you after making payment and request that their cost be voided and the product be returned. When you offer a hosted payment page, you can revoke this transaction after it has been made but before the customer receives their product. This way, your company can keep its payment record and any money due to it.

3. You Can Lower Your Merchant Account Fees

Credit card fees add up. And having your merchant account can cost you as much as 15% to 18% every month. When you use a payment page, the credit card processing fee is paid by the third party and deducted from the transaction amount that is listed on your website. It lowers your costs and makes it more financially viable to accept these payments.

4. It Brings in More Prospects

Your website won’t be left out of the loop regarding online sales when you offer a payment page. A payment page also gives your company more control over where these payments go. Suppose you’re interested in promoting your business internationally or opening up a second store. In that case, a payment page gives you that extra opportunity to get more customers on your side.

A hosted payment page is a great way for your business to open itself up as a legitimate online presence. By establishing yourself as an online authority, you can attract more customers and expand your customer pool internationally. But using a hosted payment page, you can still keep your customer’s payment information secure and private.