Ever since it was first used as an experimental addition in the transaction flows of small Netherlands-based businesses, iDEAL has become one of the frontrunners of European online payments.

With its simplistic system that seeks to quickly complete transactions through an authenticated bank debit, iDEAL makes online payments easy. Thanks to its user intuitive system and immediate payment confirmation, iDEAL has managed to become the most popular online payment method among the Dutch. This is evident in its 55 percent market share!

Seen as the Dutch counterpart of other popular payment methods such as Giropay and Bancontact, it’s clear that this tool has become highly sought-after for the right reasons.

If you’re an online seller looking to offer as many European payment options as possible, this Dutch-developed payment system is a must. Fortunately, integrating it is as easy as accepting iDEAL payments via Stripe!

A Step-By-Step Guide To Accepting Payments Through Stripe

Although it may seem quite complex, fine-tuning your website’s payment pages to accept iDEAL payments doesn’t have to be as difficult because Stripe has streamlined the process through its Sources tool.

With the help of this single integration path that seeks to create payments using any supported method, Stripe users in the United States (and Europe, as well) can quickly accept payments from Dutch customers. This tool is set to help ease up the process because a Source object can be created so that a customer is redirected to their bank’s website to make a charge request— thereby completing the payment.

Let’s go over each crucial step that you’ll need to follow so that you can use Stripe (and the Payment Page builder tool integrated with it) to start accepting iDEAL payments:

Step #1: Create a Source object that will start accepting payments

The first step you’ll have to take is to create a Source object on the client-side—a process that can be found in the iDEAL Bank Element Quickstart. With this step, you can help your customers streamline the payment process by selecting their bank online instead of browsing the interstitial bank selection page.

Step #2: Have your customer authorize the payment

Once you’ve set up the source object that will be responsible for accepting payments from the most popular method in the Netherlands, the next step is to have your customer authorize them.

When you create a source, its status is initially set to “pending”, meaning that it cannot be used to make a charge request. This is where your customer will have to authorize an iDEAL payment to make the source object chargeable— which can be done by linking them to the URL provided within the Source object’s “redirect[URL]” attribute.

Step #3: Start charging the Source

After following the two steps mentioned above, you’ll notice that your assigned Source object’s status is now “chargeable” and no longer “pending”. This allows it to be used to make charge requests. To make a charge request using the allotted source, you can proceed with making a charge request by accessing the webhook handler and using the source ID as a value in the source parameter so you can complete the payment.

Step #4: Make the confirmation that the charge has succeeded

By the time everything falls into place and the Charge in question succeeds (which will show in the form of a “charge.succeeded” webhook event, the final step that you’ll need to take is to notify your customer of the successful transaction.

(For a more in-depth guide to integrating iDEAL payments using Payment Page’s integrated payment method, check out Stripe’s official guide here.)

Conclusion

Trying to meet the needs of consumers in the Netherlands entails giving them payment options that make completing a purchase easy. If you see Dutch customers visiting, yet to bounce and abandon their cart in the latter stages of a purchase, your payment options could very much be the reason. With the help of this guide, however, you can quickly and successfully tap into the Dutch market by accepting the country’s leading payment method through Stripe!

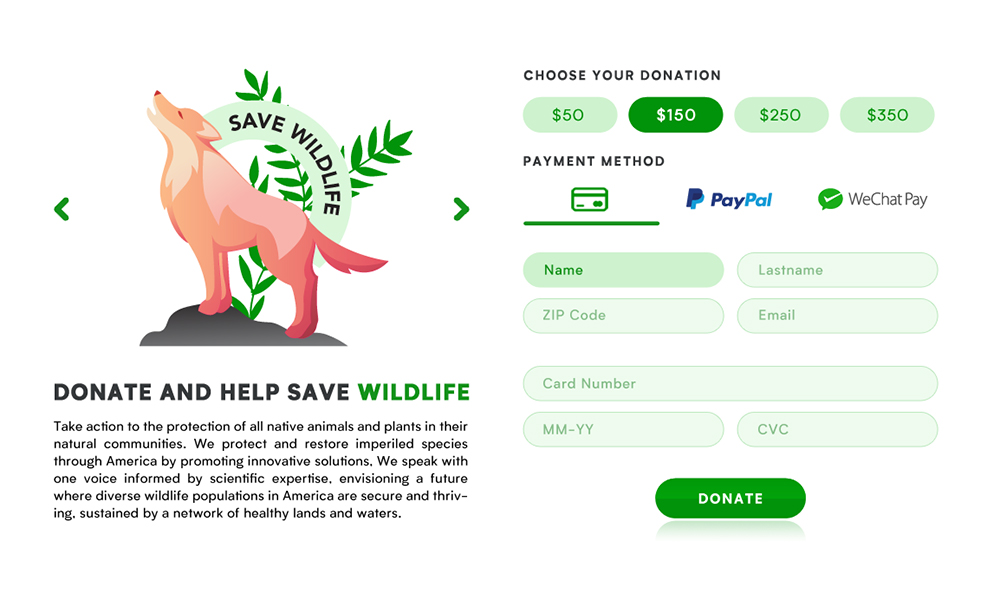

If you’re looking to accept iDEAL payments through Stripe with an appealing and effective form on your website, then Payment Page is for you. You can easily build a custom payment form or we can help you set it up, to help your business achieve more profit right away with our tools at your disposal. Get in touch with us today to see how we can help!