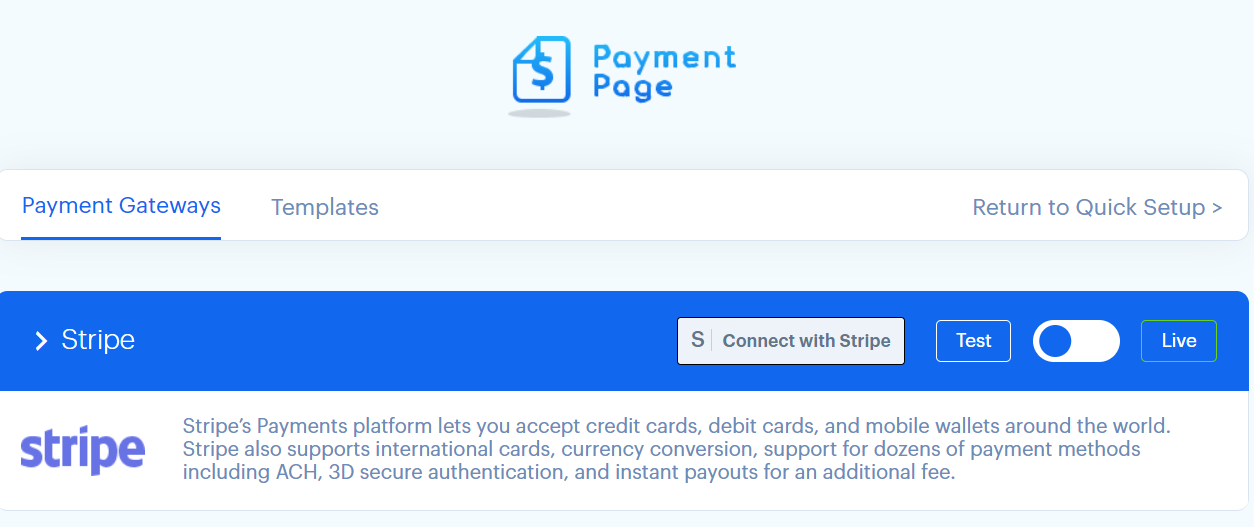

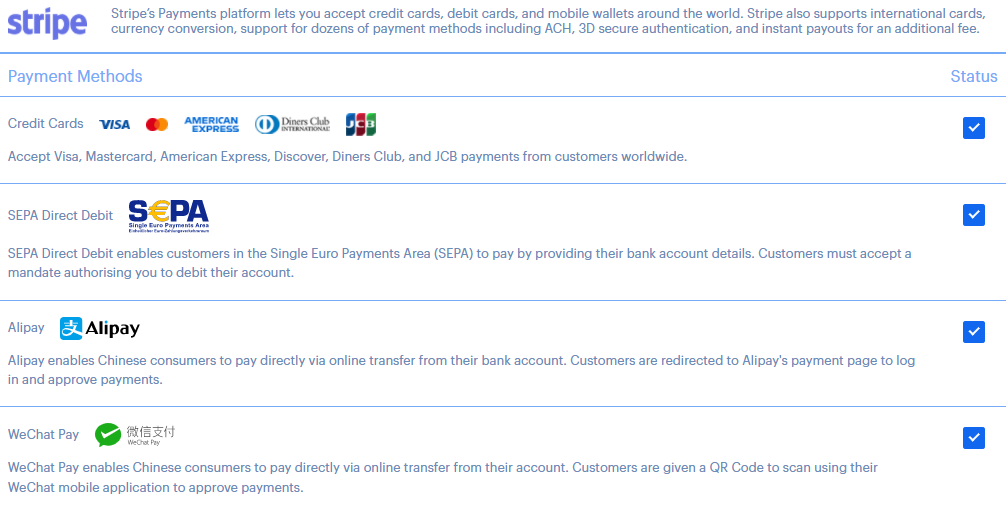

1. Find a Payment Gateway in Your Home Country

You need to find a payment gateway that accepts credit cards and other types of payment methods in your home country. Many companies support this type of payment method.

On Wikipedia, there are a lot of payment service providers that accept credit cards and other types of payments in your home country. Before you start working with a payment gateway, it’s important that you thoroughly research the various features and fees of the company.

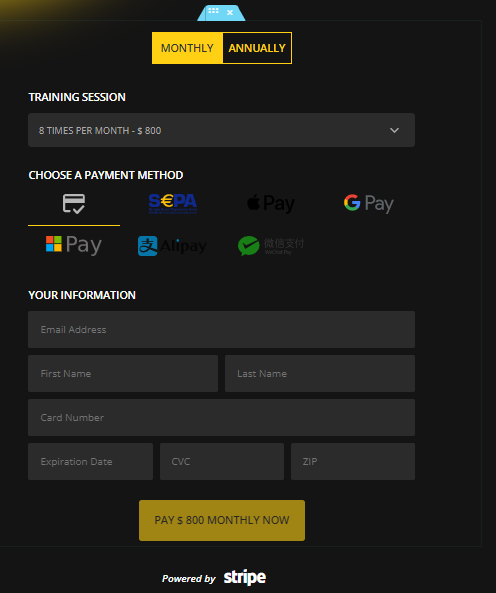

There are a lot of payment gateways that accept credit cards and other types of payments, such as PayPal, 2Checkout, and Stripe. However, there are also many other options.

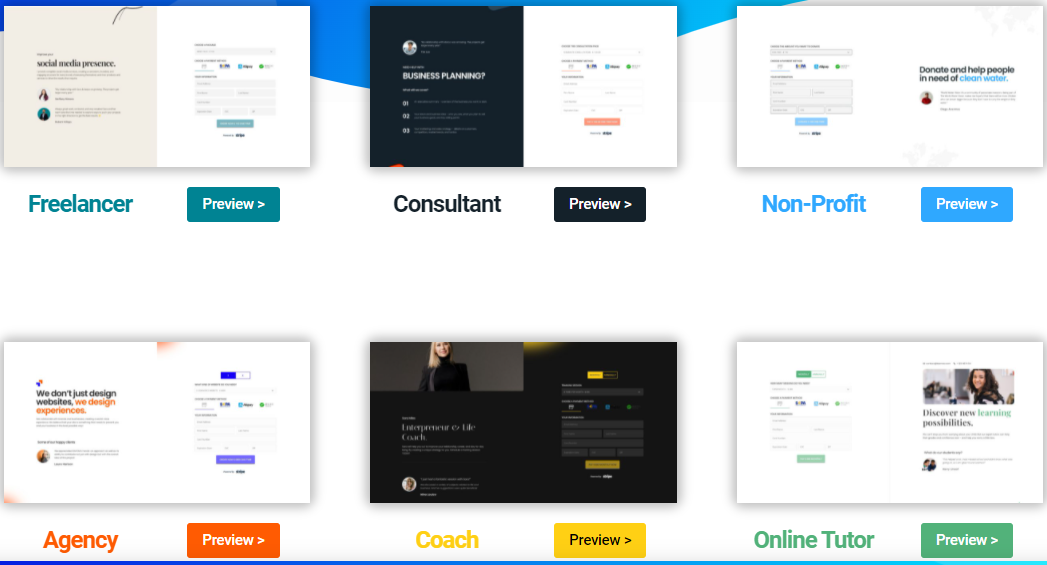

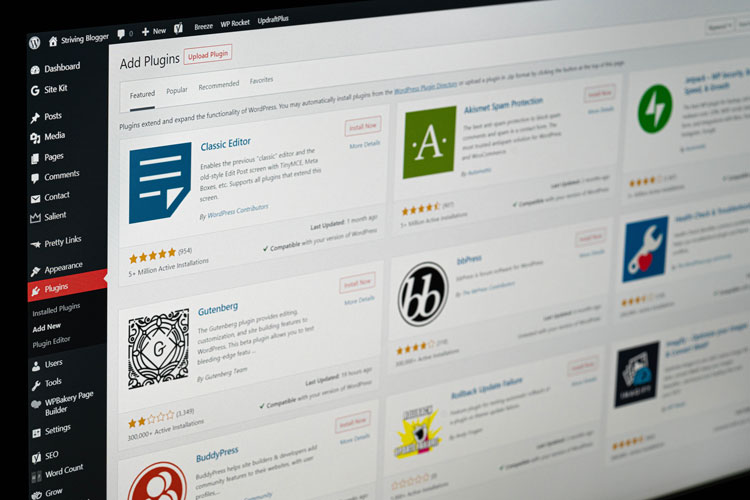

2. Locate a Compatible WordPress Plugin

Before you start working with a payment gateway, it’s important that you thoroughly research the various features and fees of the company. If you don’t want to pay for a specific plug-in, you can start by searching the WordPress.org repository.

Most plug-ins for WordPress will allow you to accept payments without additional features. However, if you want to add additional features, such as subscriptions or mixed payment options, then a paid extension is required.

Ask yourself the following when investigating WordPress plugins:

•Is there customer support offered?

•What are the reviews?

•Is there enough documentation of the plugin to make an informed decision?

•Will the plugin be easy to set up and use?

•Are there 3rd party integrations available?

Some payment plugins will require you to use a third-party payment gateway to handle the various features of their functions, such as the checkout flow. Some will also require you to use a separate payment engine, such as MemberPress or WooCommerce.

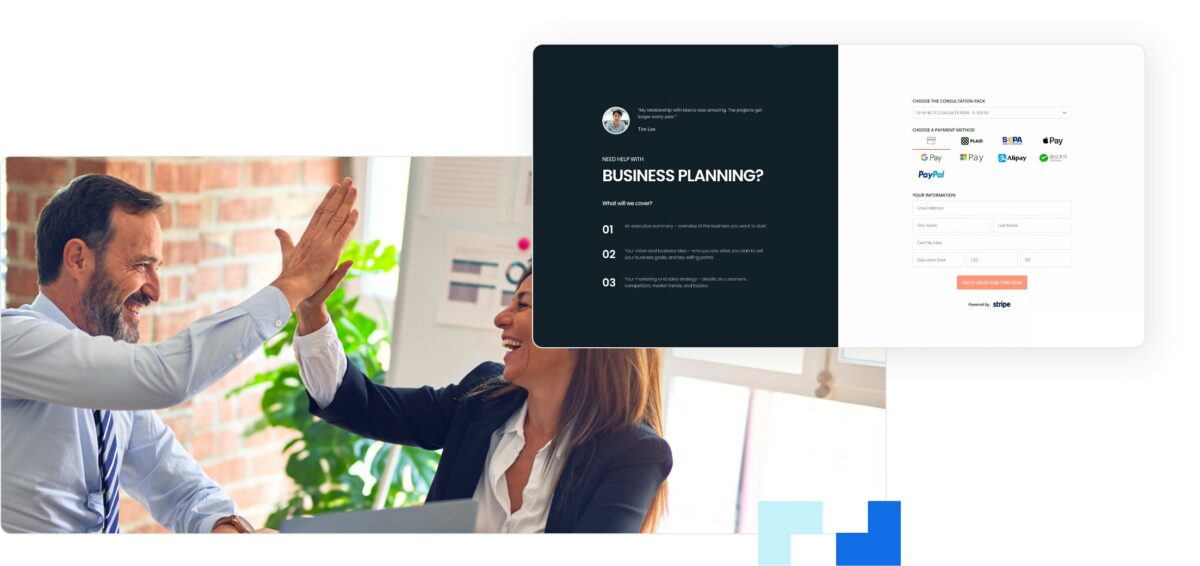

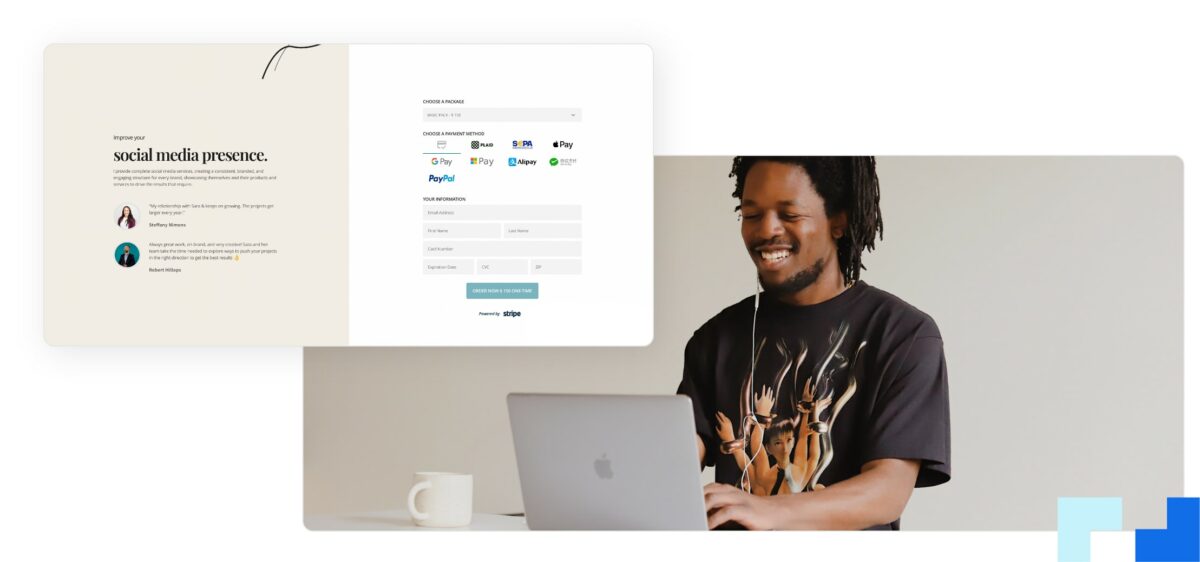

3. Set Up The Plugin and Begin Accepting Payments!

If you decide to use a payment gateway plug-in, you’ll need to make sure that you have the necessary configuration to connect your website to the gateway’s API. This will allow you to securely process payments. The documentation of the payment gateway and the WordPress plug-in should explain the steps involved in setting up the system.

Finding it Difficult to Accept Payments Using WordPress?

There are a lot of articles and guides on how to accept payments using WordPress and PaymentPage. We have a variety of articles and guides that explain how to set up a payment gateway and implement various payment methods. If you have any questions about the payment gateway or the instructions in these articles, please contact our support team.