Ever since China opened its doors to global trade and embraced the open market economy, a lot of countries have taken notice. Doing business with one of the world’s biggest sources of manpower, raw materials, and industrial goods is an advantage that businesses of all kinds cannot ignore.

For people who want to tap into the Chinese market, it can be challenging to set up a system for receiving payments from Chinese customers. If your company does not want to spend resources building a brick-and-mortar store and handling expansion into the Chinese market in the traditional manner, e-commerce is the way to go.

Why you should expand into Chinese e-Commerce

E-commerce revenues in China are expected to grow to $1.3 billion by 2024, driven by a wide range of industries but most notably in fashion, electronics, and hobbies or DIY. Presently, the average revenue per person in this 893.8 million-strong user base is $1,121.04, which can be expected to reasonably increase in the coming years.

This resilience of the Chinese market combined with the convenience of online shopping makes e-commerce ventures in the country an attractive prospect for many business owners. For companies to succeed, though, they must adapt to local preferences and habits. This includes delivering services through channels familiar to the Chinese market.

Online Payments in China

PayPal and other payment methods are not as widely-used in China. Local consumers prefer Chinese payment systems, as these accept transactions offline or through QR codes. Successfully running a business in China is often tied with providing an option for payment through one of the three biggest providers in the country; Alipay, WeChat Pay, and China UnionPay (CUP, or just UnionPay).

Ideally, integrating with all three systems is the best route for a business. This way you can have access to nearly 100 percent of the shoppers in the country.

WeChat Pay

In 2019, since introducing services in 49 countries and support for 16 currencies, the number of cross-border payments using WeChat Pay has increased significantly in China. WeChat Pay has solidified itself as a popular Chinese payment platform. This is true even though it is the youngest of the top mobile payment options, demand is only increasing.

WeChat Pay’s dominance is due to the fact that almost everyone in the country has a WeChat account, which serves as a multipurpose online network for Chinese people. Through WeChat, users can send messages privately, connect with friends, play games, pay bills, get delivery, buy transportation tickets of all kinds, and much more. Needless to say, if you live in China, WeChat is a big part of people’s everyday lives.

Businesses that want to enter the Chinese market integrate with WeChat Pay because of its wide reach. Accounts on WeChat come automatically integrated with the payment platform, which only needs to be connected to a local Chinese bank account to enable financial transactions. This platform is also supported by all devices that work with the WeChat Pay app.

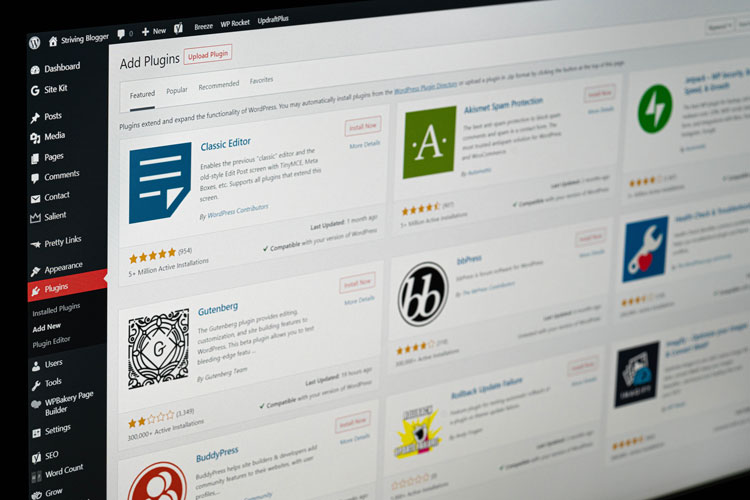

Setting up WeChat Pay directly on your website is not easy, which is why Stripe has created a partnership for most global businesses to be able to accept WeChat Pay on their websites. Using your Stripe account and the Payment Page plugin, you’ll be able to get started with WeChat Pay accounts without needing an actual account or relationship with WeChat directly, making it much easier.

If you have a WeChat Official Account, which is only available if you’ve registered your business in China, you can accept payments on your website directly through their API integration, bypassing Stripe. But this type of integration is difficult to achieve because many businesses find the regulations of creating a business entity in China too burdensome. Now, eCommerce sites don’t have to have the direct relationship with WeChat and go through all the requirements of creating a business in China.

Alipay

Though WeChat has a large consumer base and many applications in day to day life, Alipay rivals its capacity to deliver payments. This is because, as the pioneer, Alipay remains the ubiquitous name in electronic payments in China after gaining popularity as a payment solution for the eCommerce platform Alibaba.

Alipay now provides support for online and offline payment, as well as the option to settle bills and utilities. They are similar to WeChat in that they only charge fees to customers for withdrawals, and they charge similar merchant fees.

Alipay is similar to WeChat in that to accept it on your website, you’ll need a direct relationship with Alipay and a Chinese business license (unless you have a Stripe account or another gateway that has a direct relationship with Alipay).

Integrating with Stripe for both Alipay and WeChat Pay lets businesses target a large portion of the Chinese market at once because both payment systems combined dominate almost the entire market.

China UnionPay

The distinction of UnionPay is that it was established as a credit and debit card provider. This system is new to the online payment industry, but its pool of long-time clients include more than 160 banks, which issue more than five billion cards in China every year. Any person with an active bank account in the country can be considered a UnionPay customer.

What’s more, UnionPay supports a wider range of currencies and can operate in more countries. This is something its competitors are still working towards. UnionPay, because it fits the unique requirements of Chinese regulation, can offer these services easily compared to the other two platforms. This makes it a good choice for businesses that want to target countries other than China in their expansion, however, Stripe does not yet integrate with UnionPay, so you’ll need to work directly with them for a payment integration

Conclusion

Businesses that want to establish themselves in the Chinese online market should integrate with two of these three payment platforms at a minimum for eCommerce sales. Conducting research into how your products and services would best reach your target market is also necessary for this venture, like having translations and localizing your page.

Companies that want to enter the Chinese e-commerce market can partner with Payment Page to help handle their online sales in China. Our Stripe integration lets business owners place a payment form directly on their website or create a hosted payment page customized with their branding and product/service information, which serves as a channel for payments for WeChat Pay and Alipay. Get in touch to learn more.