Are you a freelancer or entrepreneur running a business through WordPress? Adding a payment option right on your website is a great way to increase conversions.

According to a study by the Baymard Institute, 18% of customers abandon their carts due to a complicated checkout process. Adding a payment option to your website instead of redirecting your customers to a third-party payment page will simplify your checkout process and increase your conversion rates.

So, how do you enable payments through your WordPress website?

You’ll need a payment gateway.

A payment gateway is a service that acts as an intermediary for monetary transactions between a buyer and a seller. Payment gateways enable customers to use different payment methods such as wallets, credit cards, debit cards, and bank transfers.

In recent years, many payment gateway providers have appeared on the market. Stripe and PayPal are among the most popular gateways — around 3.2 million websites across the globe use Stripe to accept online payments. Stripe offers easy setup and a flat rate fee, making it an excellent choice for freelancers and other small businesses.

To set up Stripe for your WordPress website, you’ll need to install a To set up Stripe for your WordPress website, you’ll need to install a Stripe WordPress plugin, like Payment Page.

Let’s see how you can use Stripe for WordPress to accept payments and donations.

Here’s what you’ll learn:

Stripe Payment Gateway Basics

Stripe is a payment processing platform that lets customers pay on a merchant’s website. When a customer makes a payment on a website, Stripe processes that payment and transfers it to the seller’s account.

Stripe Supported Payment Methods

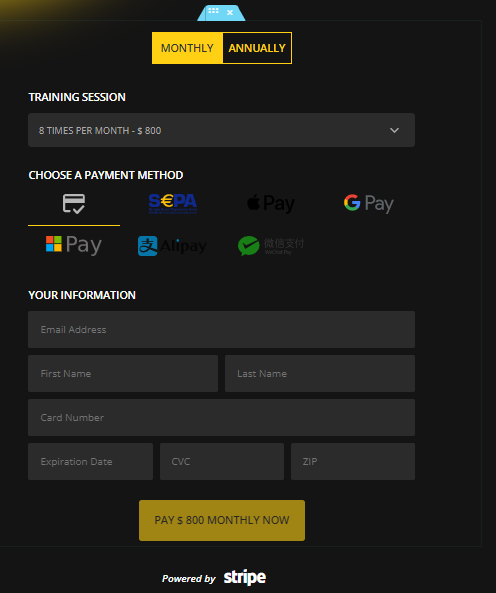

Stripe offers diverse payment options, empowering your customers to pay using their preferred payment method.

The Baymard Institute study found that 9% of customers abandon their online shopping carts if there aren’t enough payment methods. While that number may not seem high, why take the risk when you don’t have to?

Offering diverse payment choices by setting up Stripe for WordPress will help your customers quickly finish the checkout process.

Stripe supports a wide range of payment options for online transactions, such as:

- Credit and debit cards

- Wallets, including:

- Google Pay

- Apple Pay

- Alipay

- WeChat Pay

- Microsoft Pay

- Click to Pay

- Bank directs debits and credit transfers

- Bank redirects

- Buy now, pay later methods

How Does Stripe Work?

A business needs a merchant account to accept credit or debit card payments. When you use the Stripe payment gateway, you won’t need to open a merchant account as you’ll be using Stripe’s.

Here’s what happens when a customer makes an online payment on your Stripe-powered WordPress site:

- Stripe encrypts the payment information and sends it to the business’s bank (acquirer).

- The transaction passes through the credit card network to the customer’s issuing bank.

- The issuing bank verifies the transaction and transfers money to the acquiring bank.

- The acquiring bank deposits the money in Stripe’s merchant account.

- Stripe transfers the money from the merchant account to the online store owner’s account.

Stripe Payment Gateway Fees

Stripe doesn’t have monthly or yearly fees. Instead, it debits fees per transaction. Stripe charges a flat rate of 2.9% plus 30 cents per transaction for online wallets and debit and credit card payments.

For bank account transfers, Stripe charges the below transaction fees based on the type of transaction:

- ACH credit: $1 per transaction

- ACH debit: 0.8% per transaction

- Wire transfer: $8 per transfer

Now that you know how Stripe works, let’s get into how to set up Stripe on your WordPress website.

How To Set Up Stripe on WordPress

After opening a Stripe account, you’ll need to install a Stripe WordPress plugin to start accepting payments on your WordPress website.

E-commerce plugins like WooCommerce come with Stripe integrated. If you don’t want to create a complete e-commerce checkout, go for a standalone Stripe plugin like Payment Page.

Stripe also offers a new payment link feature where merchants can create Stripe-hosted payment links and share them across emails, messages, or chats. Alternatively, you can redirect your customers to a page hosted by a third-party payment gateway.

Let’s look at each of these options in detail.

Standalone Stripe WordPress Plugins

Stripe WordPress plugins are the simplest way to set up a payment page on your website. Some of these plugins offer both free and premium plans. You’ll find two types of Stripe plugins:

Plugins for Payment Buttons

If you have a product page and need simple payment buttons, you can use plugins like WP Simple Pay. Once a customer clicks the pay button, a payment form pops up to collect the customer’s card details.

While these plugins are simple, they offer a very basic payment form. You won’t be able to customize your payment page or collect additional customer information.

Stripe Plugins With Payment Form

If you want to create a beautiful payment page to match your brand, you need to go for form-based Stripe plugins. These plugins will integrate Stripe with your website and empower you to design a customized payment page.

You’ll find several form-based payment plugins like Payment Page and WPForms. Some of these plugins provide a simple form with basic customizations. But plugins like Payment Page offer advanced customization and styling options to create versatile payment pages.

Top Stripe WordPress Plugins

Here are a few standalone Stripe WordPress plugins that’ll help you enable Stripe payments:

- Payment Page

- WPForms

- PaySimple

- WP Simple Pay Lite/Pro

- WP Full Stripe

- WPSmartPay

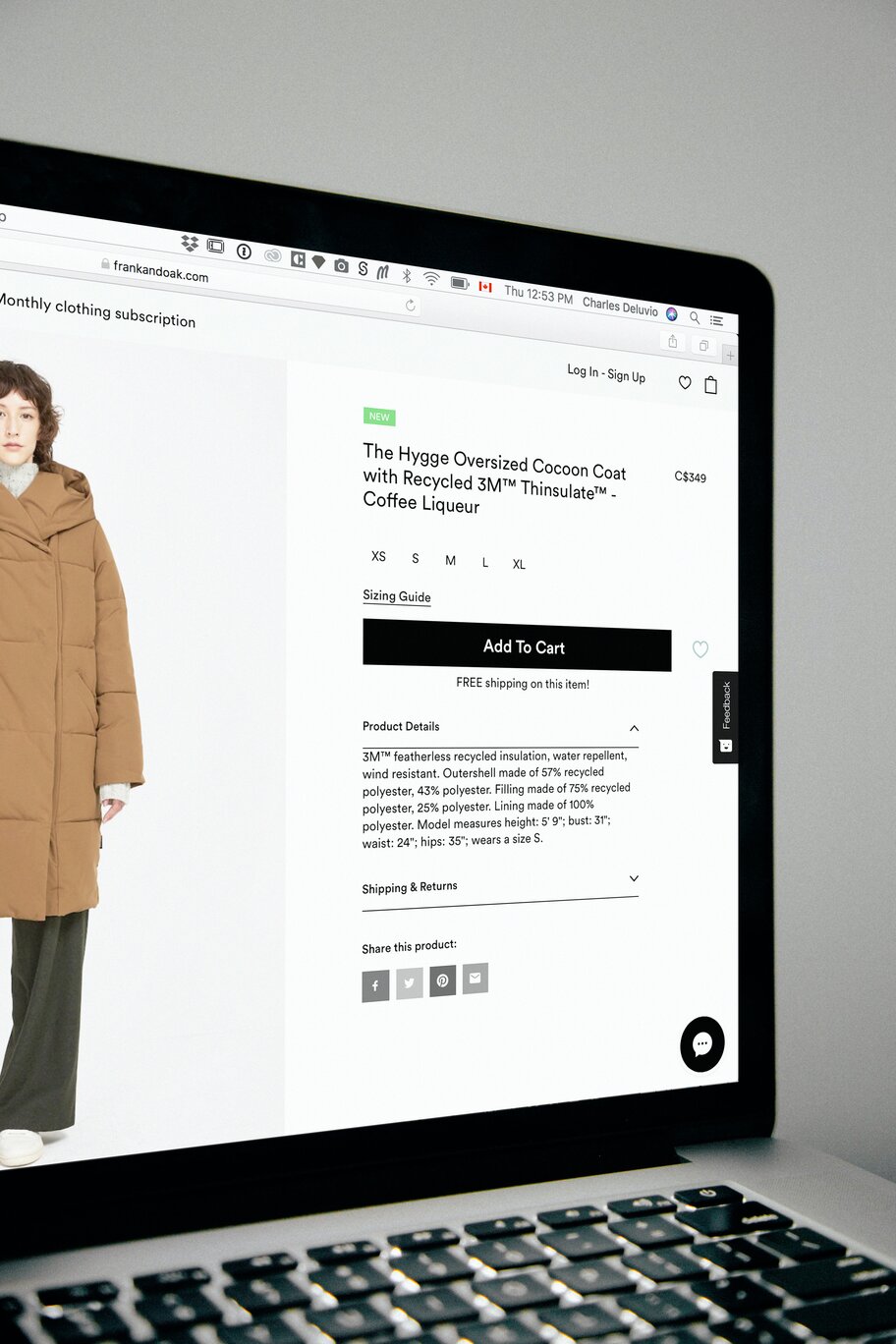

Stripe Integrated E-Commerce Plugins

If you’re planning to build an online store with a full e-commerce checkout flow, you can go for WooCommerce or Easy Digital Downloads. These plugins come with Stripe integration.

While this option is suitable for an e-commerce store, building a full-fledged WooCommerce store might be overkill if you just need to offer a few services or set up a subscription service.

Stripe Payment Links

Payment Links is a new Stripe functionality that helps you create a simple payment page hosted by Stripe. You can then share a link to your hosted payment page over email, WhatsApp, or social media channels.

While Stripe Payment Links is a simple option to set up a payment page, you’ll only get limited customization options. Also, a payment page hosted on a domain outside your business’s website might not look very professional.

Link to a Third-Party Payment Gateway

If you don’t want to make changes to your website, you can redirect your customers to a payment page hosted by a third party. While this option is quick and easy, redirecting your customers to a different page may add checkout delays and lead to cart abandonment.

How To Accept Payments on Your Website Through Stripe + Payment Page

With Payment Page, you’ll be able to create beautiful, Stripe-powered payment forms that match your brand. Payment Page is a Stripe verified partner vetted by Stripe for security and quality of service.

Payment Page is suitable for freelancers, coaches, NGOs, and other online businesses. With a few simple steps, you can accept donations or create subscription plans.

Here’s a step-by-step guide on how to create a beautiful Stripe-powered payment form:

5 Steps To Set Up a Stripe-Powered Payment Form

Step 1: Download and install Payment Page on your WordPress website.

Payment Page offers a freemium account if you would like to experiment. We also offer Premium, Pro, and Personal plans if you need advanced features. Before starting out, ensure your website has an active SSL certificate for secure data transfer.

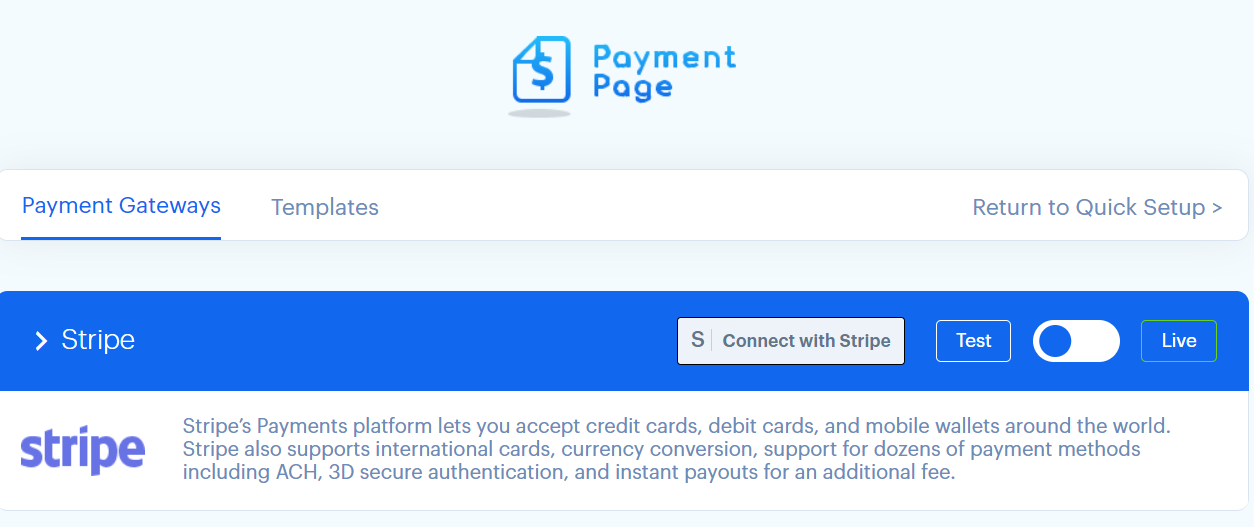

Step 2: Connect your Stripe account in test or live mode.

On your WordPress dashboard, click the Payment Page icon to connect your Stripe account to WordPress. You can connect Stripe in test mode first and if everything looks good, enable Stripe payments using the live mode.

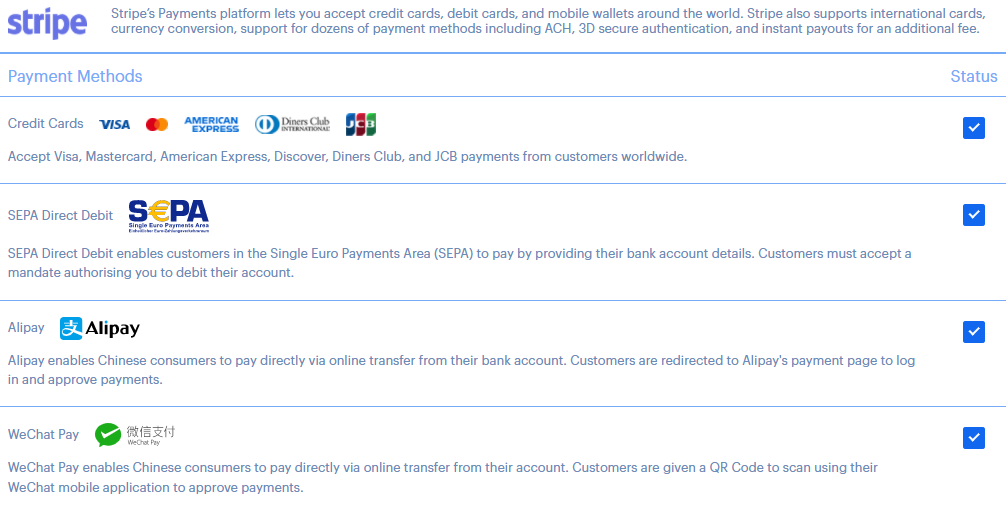

Step 3: Activate the Stripe payment options you want to include.

Payment Page supports all Stripe payment methods like credit cards, debit cards, and wallets. We’ve also added Plaid + Stripe integration to accept ACH direct debit or credit.

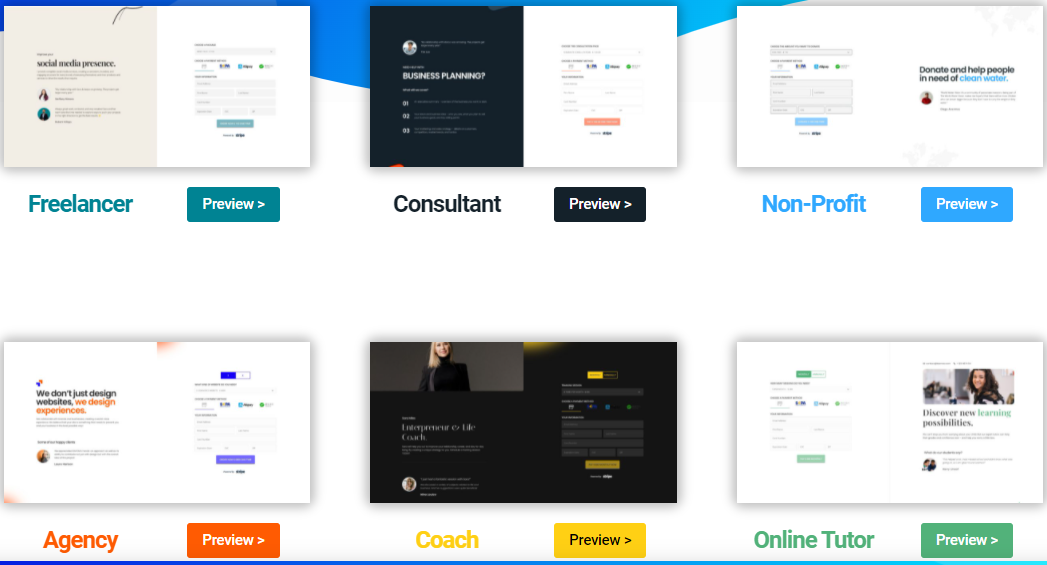

Step 4: Import and customize a template.

Payment Page has 11 stylish payment form templates to cater to any online business — freelancers, NGOs, coaches, agencies, or SaaS. Once you import a template, configure the fields of your payment form and save changes.

Step 5: Publish your payment page and start accepting Stripe payments on your WordPress website.

Final Thoughts: Accept Online Payments by Setting Up Stripe for WordPress

Millions of websites rely on Stripe to accept online payments. Creating a Stripe-powered payment page will boost your conversion rate. Stripe is a PCI Level 1 service provider, which means you can trust the service with your customers’ credit card information.

You have multiple options to set up Stripe payments on your WordPress website, such as:

- Stripe WordPress plugins like Payment Page

- Stripe integrated e-commerce plugins

- Stripe payment links

- Third-party payment pages

Are you ready to take your business to the next level by accepting online payments? You only need a few minutes to set up a highly customized, Stripe verified payment form with Payment Page. Get started today.