While the payment industry has experienced rapid positive changes over the years, the pandemic has made it necessary to adapt even faster. From the changes in consumer shopping habits and the drop in international trade, the payment industry faces many implications. One of the most obvious ways the coronavirus has impacted the payment industry is the increased demand for digital payment methods that the payment industry has to facilitate.

There are many other developments the payment industry has undergone as a result of the pandemic. Here are a few examples:

1. Consumer buying and paying habits have changed

There is an obvious in a consumer’s buying habit, from reducing in-store purchases to the increased need for sanitation products. Nevertheless, the most significant change here is the fact that the majority of all customers are opting to shop online. This also constitutes the fact that the method by which people pay has also changed.

No longer are people using cash to pay for their groceries, clothing, and other necessities. Even those going to stores in-person are opting for simpler and safer solutions, such as contactless payments using debit or credit cards and mobile wallet payments. This has caused many merchants who have not employed a contactless payment option to suffer greatly.

As a result, the need for POS (point of sale) systems like terminals has increased to facilitate this “new” way to pay. For the payment industry, this translates to an increased need for their services, allowing them to do great business despite the pandemic.

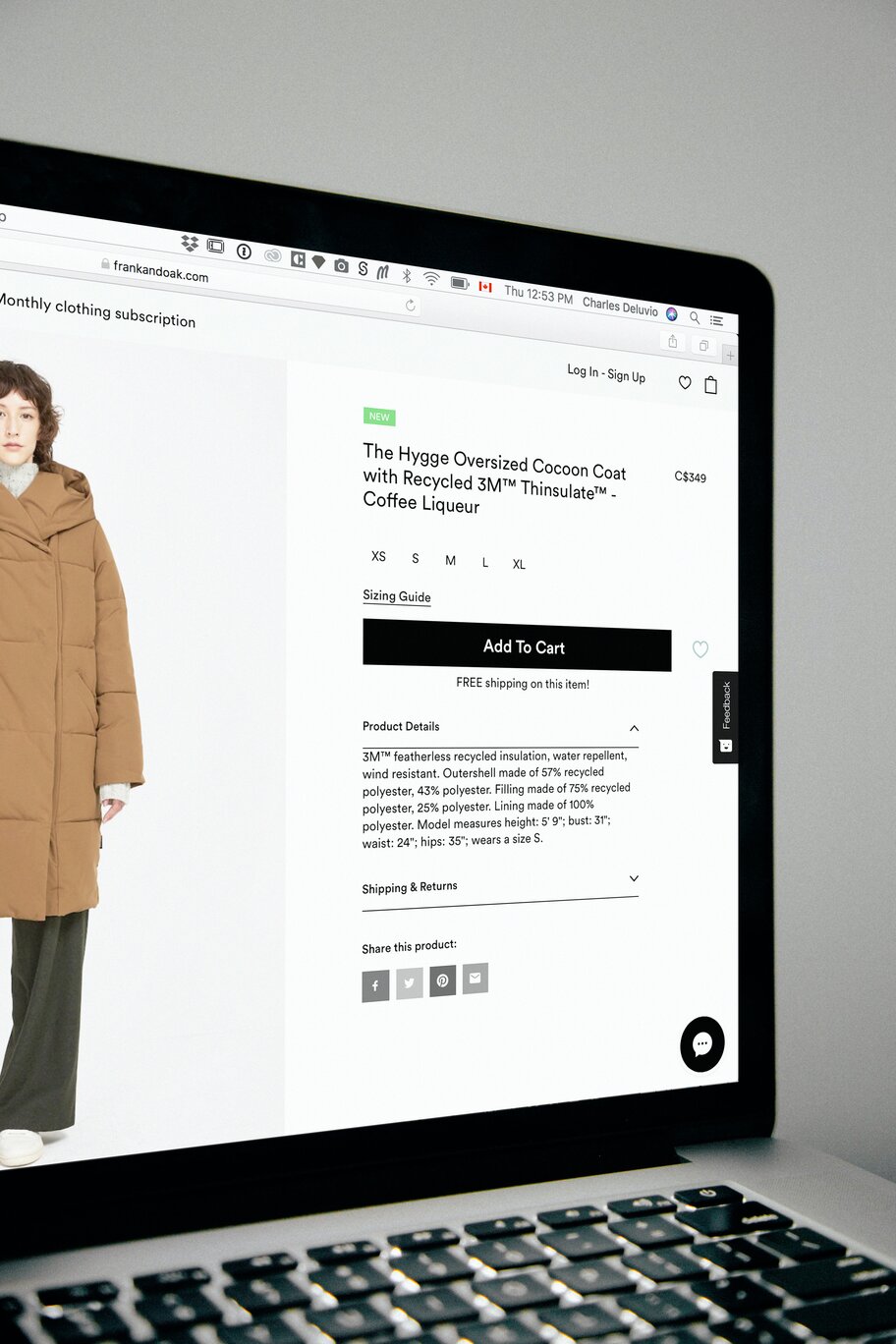

2. E-commerce has never been so popular

For many small and large businesses around the globe, in-store sales have been declining rapidly. The only way for many of these to survive is to provide their products and services through online means. Essentially, the movement to e-commerce has become a must if a business wants to continue operating.

The establishments that have already set up online payment solutions have reaped the benefits. With quick and easy online payment solutions implemented, customers can quickly pay for the things they need without handling physical money.

For those that have yet to implement online payment methods, the need for payment services providers has increased phenomenally. Besides the usual online payment solutions, additional services like financing options have allowed the payment industry to press on.

Put simply, with e-commerce gaining in popularity in the face of the pandemic, online payment solutions have been sought after by many. With their checkout processes facilitated by service providers, not only do they reduce the burden of handling payment, but they continue to keep their business alive through digital means.

Conclusion

As one can see, the pandemic has driven many businesses to go digital, whether in the form of contactless payment or offering an online store. Whether it is recurring payments, reduced fees, or contactless payment, all of these are new payment methods that many conventional businesses may have to implement. In effect, the payment industry has and still is facing rapid changes due to the coronavirus. The need for new payment methods has driven them to provide better software and other POS solutions to facilitate the changes, benefiting both the solution user and the solution provider.

Payment Page is a payment page builder driven to offer multiple payment solutions to make the consumer’s life easier. If you are looking for a solution to accept payments for your website, use our WordPress plugin to create a hosted payment page! Get in touch with us today.