No matter how far the modern business landscape has come, the common problem of shopping cart abandonment is one that continues to persist among all types of businesses.

Whether you’re selling car parts, food products, shoes, or clothing, customers will go through everything you have on sale, read all the available reviews, and put in their order, only to abandon their plan and not pay at all. This particular problem has become so common that almost 70 percent or shopping carts are left abandoned and eventually act as a pillar of potential profit that is never realized.

As annoying as this issue may be, the truth is that it’s only a mere indicator of a bigger problem at hand: There are other details on your payment page that are causing lower conversion rates.

A further explanation

While there may be many different ways to explain why shopping cart abandonment is at an all-time high, the main explanation that any e-commerce website owner should be aware of is the expectation of seamlessness.

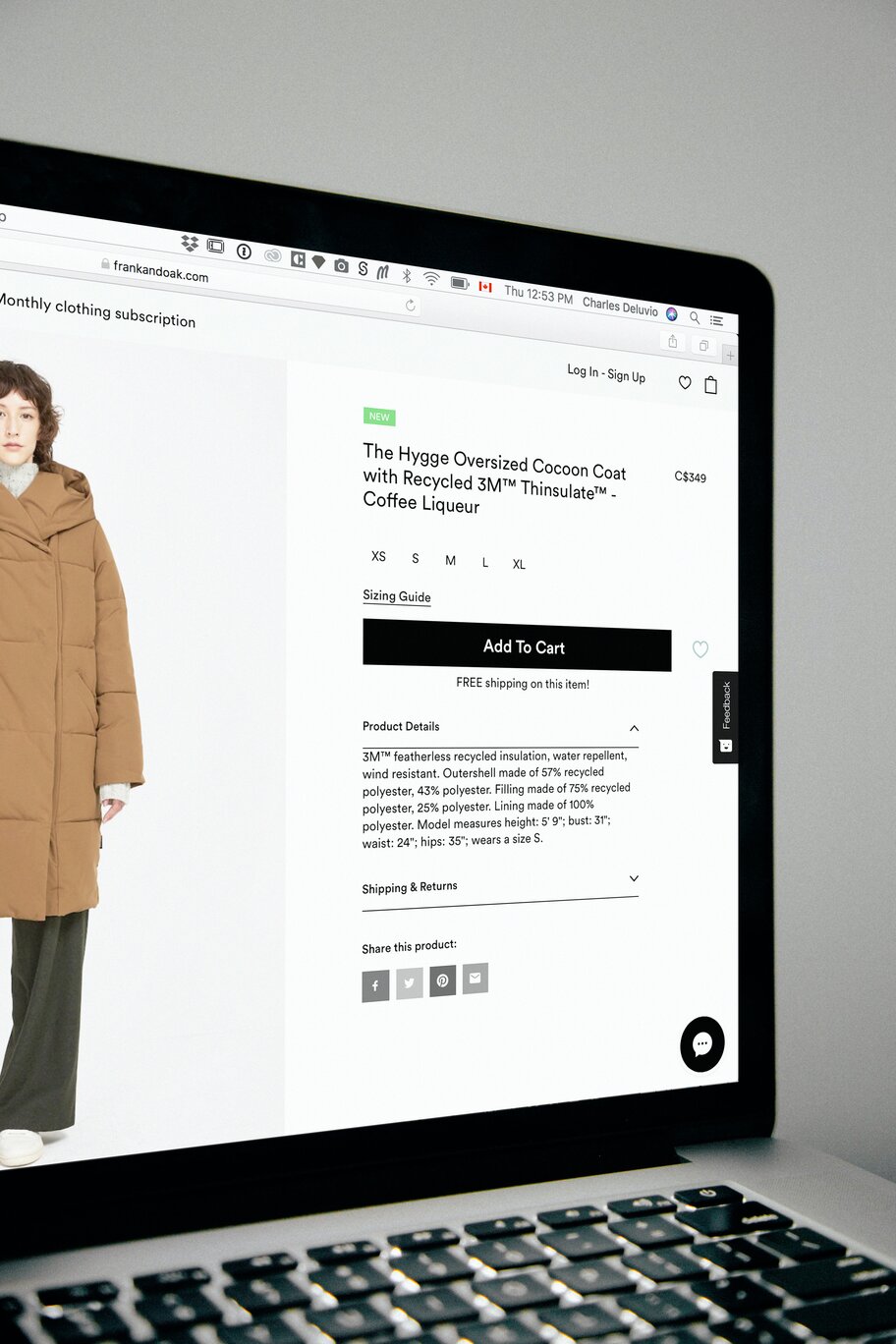

Although most owners can argue that nothing could possibly be perfect when it comes to putting a checkout page together, the truth is that customers expect near-perfection in every purchase. Certain mistakes, such as long load times, hard-to-read texts, and fields that are inconvenient to deal with all pose the significant risk of having more abandoned carts, which can lead to compromised returns.

On avoiding abandoned shopping carts

Fortunately, solving the problem of shopping cart abandonment isn’t an impossible feat as most claim it to be because any situation can be turned around with the help of a few simple, yet effective tips. If you want to reduce the occurrence of this issue, take the time to incorporate these key pointers into your next hosted payment page or Stripe checkout page update:

Tip #1: Streamline your checkout process by reducing the number of form fields

When people turn to the Internet to satisfy their wants and needs, they don’t want to end up typing into a long-winded essay form that’s no different from a credit card or mortgage application.

Once the customers make up their minds, it’s absolutely essential that you capitalize on the period of intended purchase before they change their minds by streamlining the whole process. A quick and easy way to do this is to use Payment Page’s customizable fields to get straight to the point and ask customers only for the exact pieces of information you need! By taking the time to cut down the number of fields needed for entry and eliminating unnecessary steps, you can shorten the fill-in period and streamline your way to profits!

Tip #2: Add guarantees to your checkout page

Among all the different motivating or driving factors that cause potential customers to drop their orders before paying, none are more pivotal than the security concerns that they have.

Customers now are inclined to watch out for their safety by double or triple-checking the legitimacy of checkout pages because of the sensitivity of their information. Fortunately, you can easily circumvent this problem and assure your customers that their information is stored securely by adding security badges and using Payment Page to make your checkout page look far more authoritative!

Tip #3: Outfit your checkout page with more payment options

Aside from security, one of the most pivotal reasons most customers end up leaving their shopping carts is the concept of payment options, or the lack thereof. With the help of Payment Page, however, you can easily avoid losing potential customers by adding more payment options for your customers to use so that you can easily accept customers worldwide!

Conclusion

As troubling as the experience of having high shopping cart abandonment may be, you can simply solve the problem at hand, and best prepare yourself for success by making a few tweaks to your checkout page. With the help of the three tips mentioned above, you’ll be able to start seeing an improvement in your results right away and prevent any problems from coming up in the long run!

If you’re looking to accept credit card payments worldwide or use ACH bank transfer with an appealing and effective form on your website, then Payment Page is for you. You can easily build a custom payment form to have a more profitable business with a user-friendly tool in an instant! Get in touch with us today to see how we can help!