North America spends over $25 billion in check processing costs each year. Every single check a company writes costs an additional $10. Switching to electronic payments helps reduce the paper, printing, mailing, and processing costs for these checks.

Making the shift, though, is easier said than done. It can be challenging to convert in-house processing systems, and not all vendors and contractors are willing to let go of physical check payments. A happy medium would be to set up an online payment processing option.

The benefits of having an online payment form

Online payment helps you save money. Employees who process checks can work on other tasks. What’s more, outsourcing means doing away with having to update payment processing systems onsite.

Moreover, securing financial data requires stringent protocols, and it makes your financial department responsible for managing incredible amounts of risk. Outsourcing takes the worry for cyber theft off your hands and gives it to a team specializing in it.

In addition to theft, check fraud is another thing that sellers and retailers should monitor. This type of fraud can come from inside the company or from people posing as vendors. An adequately certified external team will have the resources to prevent fraud.

What options are available for my company?

Online modes of payment have evolved beyond bank transfers and credit card purchases. Here are some of the most common payment methods you can access online in 2020.

Via debit and credit cards

This method is the most basic way you can accept payments through the internet. You should choose between enabling a dedicated merchant account or using an intermediary holding account, and these have different business processes and funding times.

A dedicated merchant account is like an internet-based account expressly for receiving payments for your online offerings. Meanwhile, an intermediary account acts as a clearinghouse for cash, mainly from transactions involving foreign currency.

Electronic checks through ACH Processing

You could also include payments through electronic checks, which are direct debits of bank accounts. With ACH or automated clearing house processing, the customer inputs their information on an online check interface. After this, the software processes the payment and sends it through the ACH network for clearing.

Payments through mobile apps

If you have a combination of physical and online stores, you can set up a mobile app system that allows you to receive payments by dipping a chip card, swiping a credit card, or keying in a number. Paying through mobile apps is convenient for many people, since they do not need to bother with physical notes, coins, and sometimes even cards.

Through online payment gateways

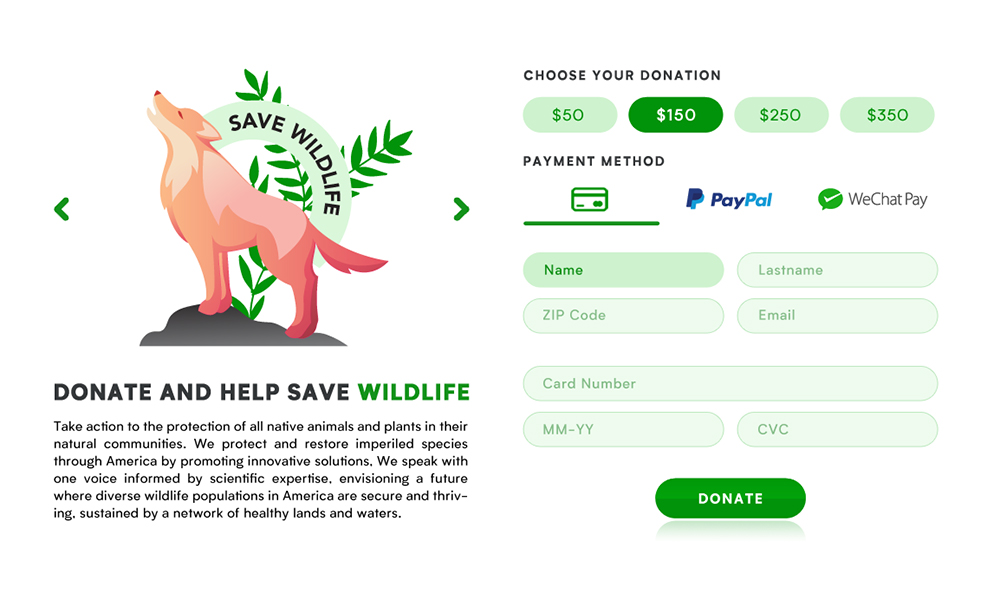

If you have an e-commerce store, adding a hosted payment page allows customers to pay directly on your website. You can even have returning browsers create accounts. It lets them save their delivery and payment information and speed through billing and ordering.

With online payment forms, you can offer various methods like credit, debit, or e-check. This method also integrates well with your social media marketing strategy, since you can link your page through email newsletters or social posts.

Using click-to-pay invoicing and recurring billing

Email invoicing allows people to pay bills without leaving their inbox. Instead of asking them to open your app or visit your website, you can send the invoice to your customers through e-mail and give them a receipt right after completing the transaction.

You can pair this with recurring billing, a popular way for customers to settle monthly dues for subscriptions. This is convenient for both the customer and the vendor; they do not forget to pay their bill, and you get your payments on time.

Conclusion

More and more payment options for your business are coming out online. While you should offer more than one payment method, you should not provide all of the options discussed. Study your core audience and learn what they use in their everyday life. Responding with two or three tailored solutions is better than offering five ill-fitting ones.

With Payment Page, you can customize your payment solutions for your audience. Our WordPress plugin allows you to integrate a Stripe checkout or other payment gateways into your website. Join us today or contact us for more information!