For Android users, Google Pay is an online shopping savior. Customers can simply select it as a payment method and use a credit or debit card to settle their purchase. You can incorporate Google Play into your hosted payment page, as it is popular among eCommerce websites, digital marketplaces, and on-demand services.

What is Google Pay?

Relatively new to the payment game, Google Pay launched back in early 2018, consolidating the likes of Android Pay, Google Wallet, and Chrome payment features. Consumers can link their debit or credit cards and use Google Pay as an online or in-store payment method. They can also use the app to transfer money between users if needed.

How Google Pay Works

Overall, paying with Google is quicker and safer on sites, apps, and in stores. Not to mention, it’s free for both sellers and buyers.

1. In-Store

In retail shops or restaurants, Google Pay makes for an excellent contactless payment method that incorporates near-field communication technology. To accept these payments at your register, you’ll first need to purchase an NFC-enabled reader and a compatible POS system. Luckily, most POS systems are Google Pay-congruent, to begin with. If your store already accepts Android Pay, you’re in luck—you won’t have to upgrade anything other than your label!

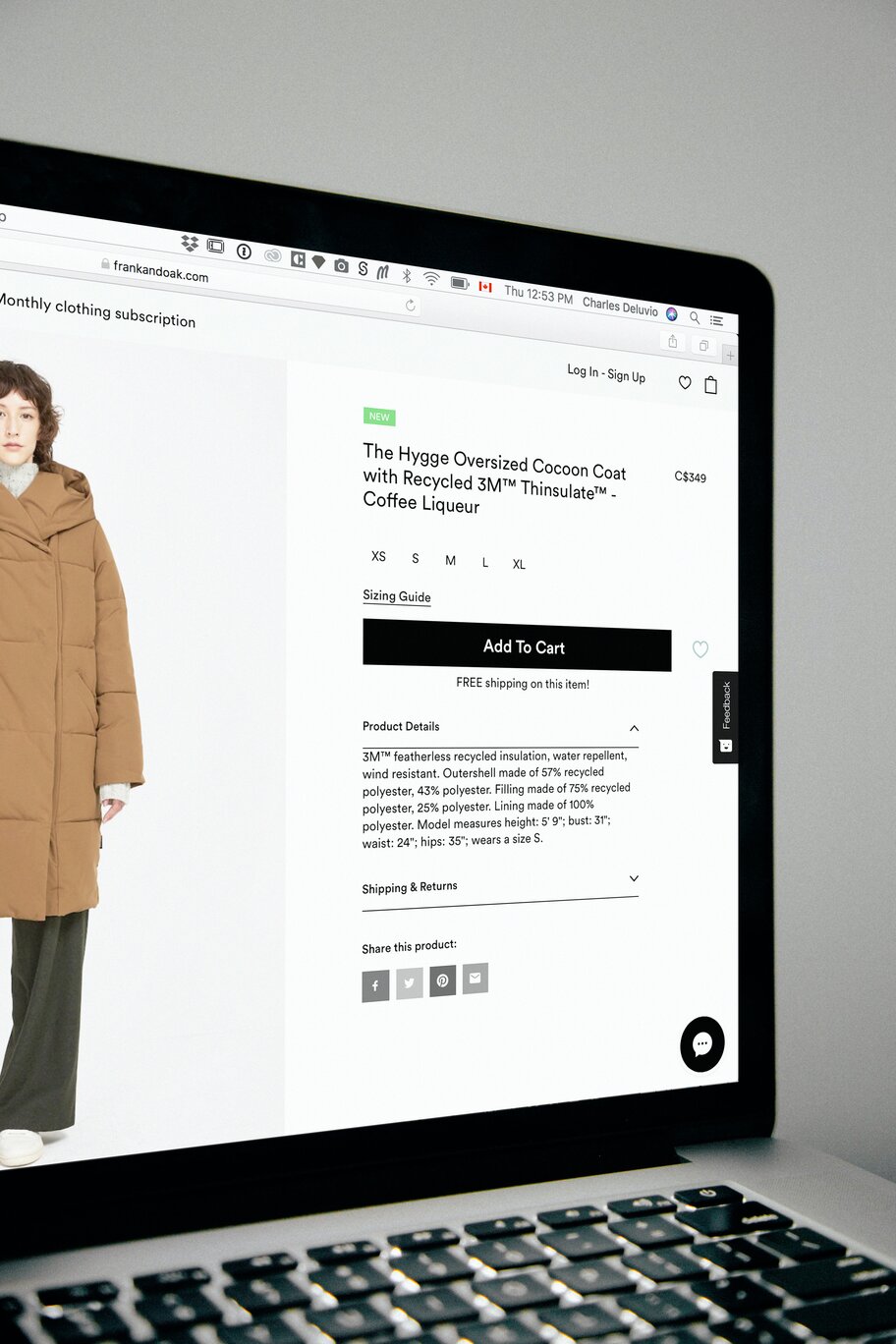

2. Online Stores

Google Pay is compatible with both desktops and mobile devices. To program the service, use your Google Pay API. Apply for a Google Merchant ID on your device and wait for the approval. Then, with a little bit of coding, implement the API onto your page. If you’re not very confident in your coding skills, you can use a POS service that is already Google Pay-integrated.

For customers shopping online with Google Pay, checking out is as easy as one click. Instead of entering payment information every time, they can save their details on a single interface—Google Pay.

Google Pay Features

Google Pay isn’t just a gateway—it helps sellers incentivize their customers with a heap of enticing features.

1. Rewards and Gift Cards

Who doesn’t want to be rewarded for shopping? When checking out with Google Pay, customers can access reward points and loyalty perks. If you offer physical gift cards, buyers can upload them onto their Google Pay app and keep track of their balance as they shop.

2. Store Locator

Visibility isn’t all about SEO (although it plays a significant role). Customers can search nearby businesses that accept Google Pay, allowing your store to pop up on Google Maps.

3. Tickets

In the events industry? If your store offers event tickets, your customers can store them on their mobile phones with Google Pay API. On the day of the event, they can simply present the barcode on their screen.

4. Services

If you’re collecting rent or providing other services, Google Pay makes for a simple solution. If you receive more than $20,000 in gross receipts per annum, you’ll have to fill out a W-9 tax form.

Conclusion

The best thing about implementing Google Pay into your portal is that it comes completely free. However, it’s important to note that your credit card provider may charge you with a transaction fee. That being the case, Google Pay is still an ideal payment method for most Android users and is easy to work into your existing payment page.

With our payment page builder, you can accommodate flexible and global payments—no need to limit yourself to local clients. Join Payment Page today for a 30% discount on a stunning payment portal and other customizable factors.