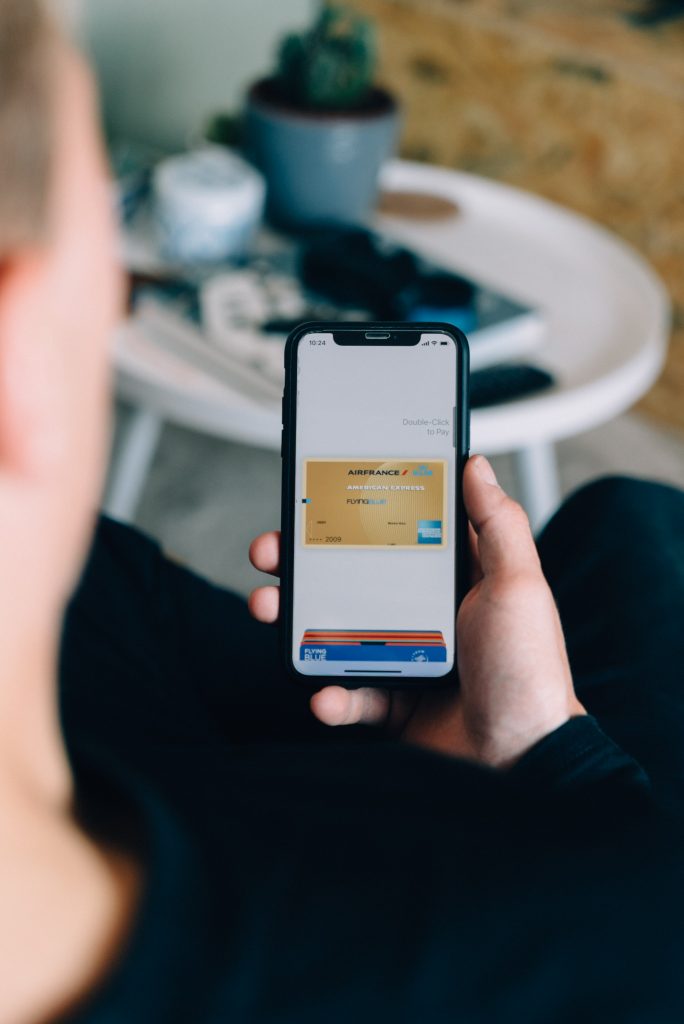

Apple Pay is among today’s leading digital wallets for iPhone, iPad, and Apple Watch users. To make online payments, users verify their transactions with Face or Touch ID, or simply input their Apple passcode. Apple’s pioneering two-factor authentication is what makes it a go-to payment method for users seeking security and avoiding the risk of disputes. If you’re in the process of introducing Apple Pay to your hosted payment page, here’s what you need to know.

What Does Apple Pay Entail?

Apple Pay is applicable to use wherever it’s supported as a contactless method and present mostly in eCommerce marketplaces and on-demand services. It can support recurring payments, such as those on a subscription, and can provide refunds to unsatisfied customers.

Apple Pay is a popular gateway across the U.S., supporting major banks and credit unions such as American Express, Visa, and MasterCard. Its system is also applicable to holders of federal-payment cards such as the Direct Express Network and GSA SmartPay.

Apple Pay doesn’t save transaction information or credit card details onto its server, making it a secure method of payment. Instead, it replaces your details with a number or token and creates a Device Account Number for each card. These tokens are encrypted, and merchants have no direct access to your card.

Apple Pay – Website Applications

To best support Apple Pay as a collection option, consider incorporating a Stripe system into your payment gateway. With Stripe, your storefront enables frictionless payments and eliminates the need to input payment and shipment details manually.

To integrate a seamless Apple Pay experience into your desktop website, allowing shoppers to check out with a fingerprint is the first step. In a single touch, you can receive payments, streamlining shipping methods, and gather contact information to exchange physical goods and subscriptions.

In 2019 alone, Apple Pay conducted roughly 10 billion transactions. Now available on various markets, your desktop shop can accommodate international customers, who make up 85% of Apple Pay users outside of the U.S.

Apple Pay – iOS Applications

With iOS SDK, eCommerce sellers can accept Apple Pay transactions through a unified source. Customers can quickly settle physical goods—such as clothing, groceries, electronics, or appliances—and services—such as club or gym memberships, hotel reservations, and event tickets—in a single touch.

Customers using their mobile devices to shop online need only to set up their Apple Wallet and connect their credit, debit, or store cards to start shopping. In some cases, user banks may request additional verification—but the process is relatively quick.

Conclusion

Increasing eCommerce sales has just as much to do with the payment options you make available as to how beneficial your products and services are. By introducing new payment gateways and incorporating various “trust” factors into your payment page, you can encourage more sales on your website.

To achieve a beautifully designed checkout page, join us at Payment Page and get up to a 30% discount upon the first launch. With our intuitive payment page builder, you can facilitate a payment process even without a unique website.